What a Tax Debt Specialist Can Do for You

Tax Debt Specialist Services That Help You Resolve IRS Issues

A tax debt specialist is a trained professional who helps individuals and businesses resolve issues with the IRS. Whether you’re behind on taxes, dealing with wage garnishment, or facing penalties, these experts know how to navigate IRS procedures and can represent you in tax matters.

What Is a Tax Debt Specialist?

A tax debt specialist is someone who focuses on resolving complex tax problems. They understand IRS rules, collection processes, and available debt relief programs.

Credentials and Expertise

Most tax debt specialists are:

- Enrolled agents (EAs)

- Certified Public Accountants (CPAs)

- Tax attorneys

Each has a different background, but all can represent you before the IRS.

How They Help

A specialist handles IRS negotiations, prepares paperwork, and defends your rights. They can submit offers, stop collection actions, and help you avoid costly errors that delay resolution.

When Should You Hire a Tax Debt Specialist?

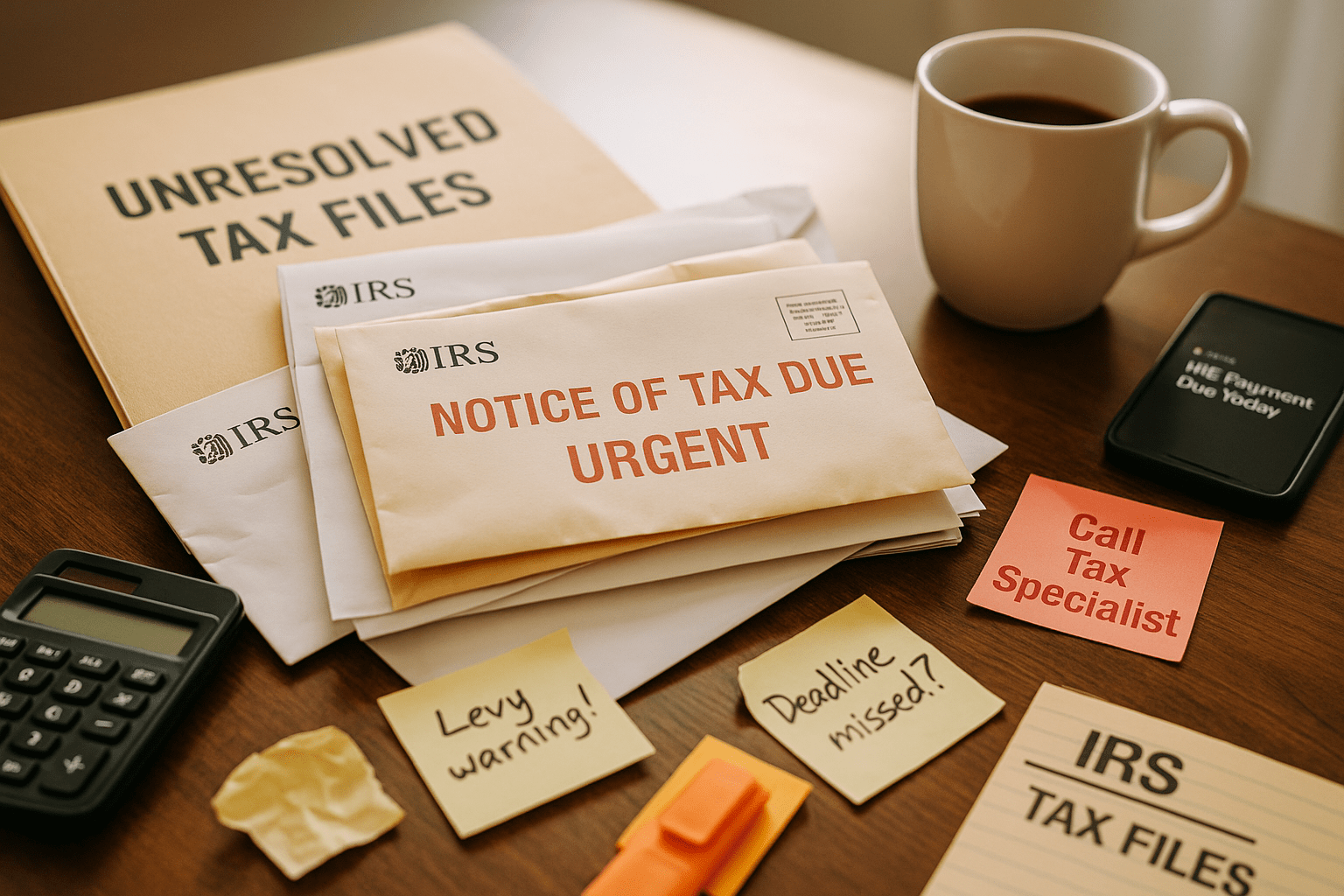

While not every tax issue requires professional help, certain red flags mean it’s time to call a specialist.

IRS Notices or Threats

If you’ve received a notice of intent to levy, lien, or audit, it’s best to act quickly with expert guidance.

Large or Longstanding Debt

Owing more than $10,000, or being in debt for multiple years, makes your situation more complex and risky.

Failed Attempts to Resolve It Alone

If you’ve been denied a payment plan or had an Offer in Compromise rejected, a specialist can help build a stronger case and refile.

Key Services Offered by Tax Debt Specialists

The right professional can take over communications with the IRS and build a strategy tailored to your financial situation.

Offer in Compromise (OIC)

They’ll prepare and submit an Offer in Compromise—an agreement that settles your tax debt for less than the full amount owed.

Installment Agreements

They negotiate manageable payment plans that work within your budget and stop aggressive collection tactics.

Penalty Abatement

Many taxpayers qualify for relief from penalties. Specialists know how to request abatement using IRS hardship and compliance criteria.

Audit Defense

If you’re being audited, your specialist can represent you, gather documentation, and reduce exposure to additional penalties.

How a Tax Debt Specialist Saves You Money

Hiring a tax debt specialist may seem like an added cost, but they can provide professional representation and guidance through IRS procedures.

Preventing Penalties and Interest

Delays or filing mistakes can add thousands in penalties. A specialist ensures that every form and deadline is handled properly.

Negotiating Settlements

They know how the IRS evaluates Offers in Compromise and can prepare and present your case to the IRS.

Avoiding Costly Legal Errors

Mistakes made when dealing with tax law can have lasting consequences. A professional ensures your rights are protected throughout.

Resolve Tax Problems Faster with a Tax Debt Specialist

When you’re in deep with the IRS, time is not on your side. The sooner you involve a tax debt specialist, the more options you may have for addressing your tax situation. Their expertise can help you navigate IRS procedures and understand available resolution options.

Connect with a Trusted Tax Debt Specialist Today

Don’t wait until the IRS begins garnishing your wages or placing liens on your property. Contact us today to speak with a licensed tax debt specialist. We can assess your situation, explain your options, and help you move forward with confidence and clarity.

Frequently Asked Questions

1. How much does it cost to hire a tax debt specialist?

Fees vary depending on the complexity of your case. Some offer flat rates, while others charge hourly. Many provide free consultations.

2. Can a tax debt specialist help me avoid wage garnishment?

Yes. Specialists can stop or prevent garnishment by negotiating payment plans or submitting emergency hardship requests.

3. What credentials should I look for?

Seek out CPAs, enrolled agents (EAs), or tax attorneys with IRS representation rights and a strong history of tax resolution work.

4. Will hiring a specialist stop IRS collection actions?

Once a specialist starts working with the IRS on your behalf, collection efforts may pause—especially if you apply for relief programs.

5. Can they help with state tax debt too?

Yes, most specialists handle both IRS and state-level tax issues, including back taxes, audits, and penalties.

Key Takeaways

- A tax debt specialist helps resolve complex IRS problems.

- They can file Offers in Compromise, stop collections, and lower your balance.

- Professionals are licensed to represent you and deal directly with the IRS.

- Hiring one early can prevent wage garnishments and liens.

- You can often save money in the long run by avoiding penalties and interest.

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.Advertising. This site is a marketing service and does not provide legal or tax advice. Submitting information does not create an attorney-client, tax professional-client, or any other advisory relationship. Results are not guaranteed. A list of participating attorneys, tax firms, and tax providers is available here.

IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems

Recent Posts

- How to Get Innocent Spouse Relief | Navigate IRS Forms and Appeals

- Who Is Eligible for Innocent Spouse Relief and How Does It Work?

- What is an Effective Tax Strategy for Married Couples

- What are the Proofs of Innocent Spouse Relief?

- What Form Do You Use for an Innocent Spouse? | Complete IRS Filing Guide