How to Use the IRS Debt Relief Form to Settle Back Taxes

IRS Debt Relief Form: What It Is and Why It Matters

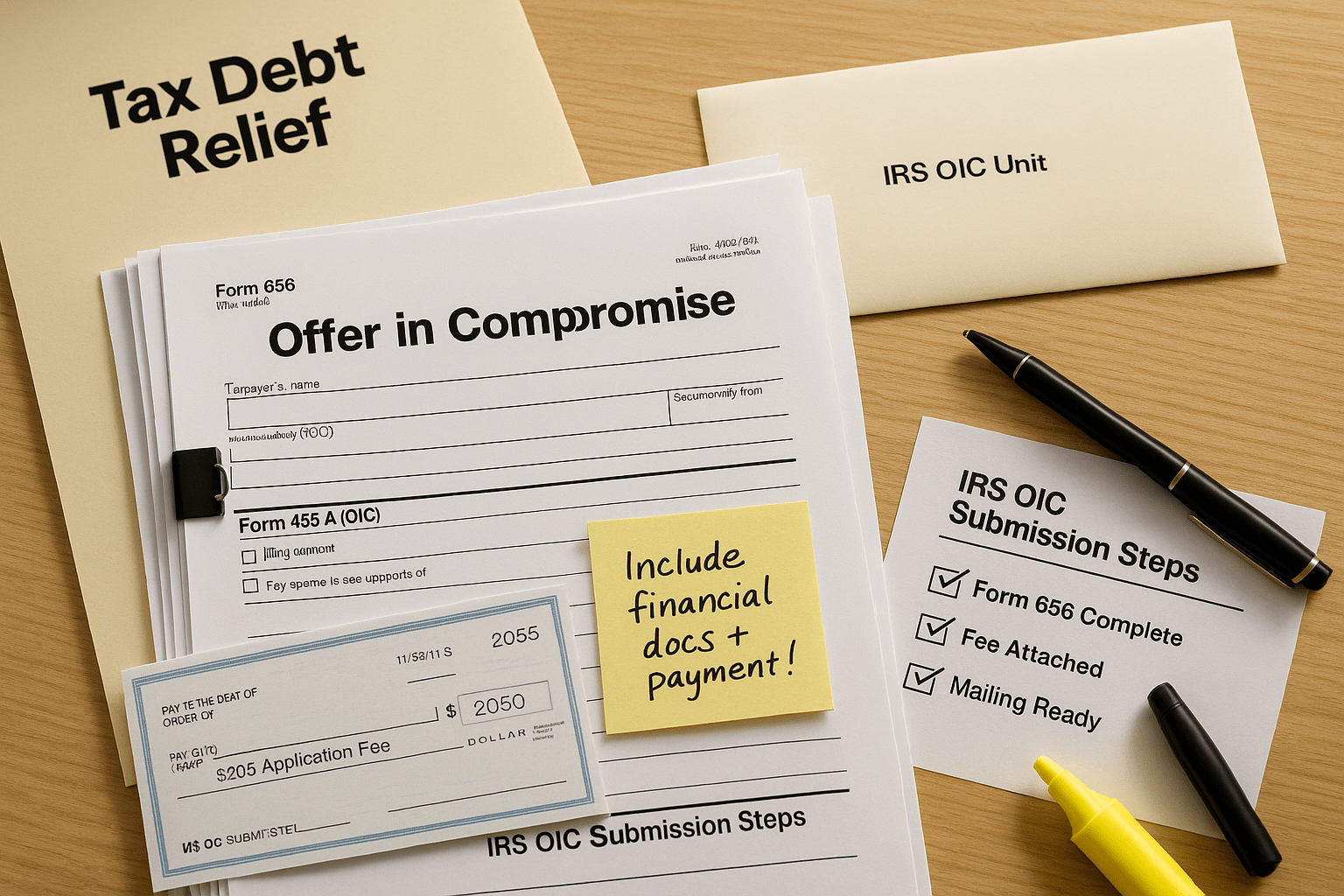

The IRS debt relief form—officially known as Form 656—is one of the IRS’s most powerful tools for taxpayers who can’t afford to pay their full tax balance. Filing this form is the first step toward an Offer in Compromise (OIC), which may allow you to settle your tax debt for less than what you owe.

What Is the IRS Debt Relief Form?

Form 656 is part of the IRS’s Offer in Compromise (OIC) program. It’s designed for taxpayers who are facing significant financial hardship and can’t realistically pay their tax bill in full.

Overview of Form 656 (Offer in Compromise)

This form is your formal application to negotiate a reduced tax debt settlement with the IRS. If approved, you may only need to pay a portion of what you owe.

What the Form Is Used For

It’s not a request for a payment plan or a delay—it’s an appeal to reduce your overall debt liability. The IRS evaluates your income, expenses, asset equity, and overall ability to pay.

Who Qualifies to Use It

Not everyone qualifies. To be eligible:

- You must have filed all required tax returns.

- You cannot be in active bankruptcy.

- You must have received at least one bill for your tax debt.

Common Types of IRS Debt Relief Requests

The IRS offers several debt resolution programs, but Form 656 is specifically used for Offers in Compromise.

Offer in Compromise (OIC)

A program where the IRS agrees to settle your debt for less than the full amount, based on what they believe they can reasonably collect.

Currently Not Collectible (CNC) Status

If you don’t qualify for an OIC, you may be able to pause IRS collection actions until your financial situation improves.

Installment Agreements

These allow you to pay your full tax debt over time. Though they use a different form, installment plans may be a fallback if Form 656 is denied.

How to Complete and File the Form

Filing the IRS debt relief form takes time and care. Mistakes can delay the process or result in automatic rejection.

Documents You’ll Need

- IRS Form 656

- Form 433-A (for individuals) or 433-B (for businesses)

- Detailed financial documentation (bank records, pay stubs, asset details)

Where to Get the Form

You can download the latest version of Form 656 directly from IRS or request a paper copy by mail.

Filing Process

- Gather required financial documents.

- Fill out Form 656 and the appropriate financial statement.

- Choose your offer amount and payment method.

- Mail the completed package to the IRS along with the $205 application fee (unless you qualify for a waiver).

Mistakes to Avoid

- Leaving sections blank

- Omitting proof of financial hardship

- Failing to include the correct fee or initial payment

What Happens After You Submit the IRS Debt Relief Form?

Once your IRS debt relief form is submitted, the IRS will:

- Review your financial documentation

- Pause collections while your application is under review

- Respond with approval, denial, or a counteroffer

Expect this process to take 6 to 12 months. If accepted, your remaining balance is forgiven after the terms are met. If denied, you can appeal or consider alternative solutions such as penalty abatement.

Get Help Navigating the IRS Debt Relief Form Process

Submitting an IRS debt relief form is not something to rush. It requires accuracy, patience, and sometimes professional help. If you’re overwhelmed or unsure, working with a tax debt specialist can provide guidance on documentation requirements and application procedures.

Need Help Filing Your IRS Debt Relief Form Correctly?

The IRS won’t forgive your debt without proper documentation. If you need help preparing your Offer in Compromise or don’t know where to start, contact us. Our team is here to guide you through the IRS debt relief form process and help you take control of your tax situation.

Frequently Asked Questions

1. What is the IRS debt relief form number?

It’s Form 656, used specifically for the Offer in Compromise program.

2. Can I fill out Form 656 online?

You must complete it manually and submit it by mail with supporting documents and payment.

3. What’s the success rate for Offers in Compromise?

Roughly 30–40% of submitted OICs are accepted, depending on accuracy and eligibility.

4. Does the IRS stop collections when I file the form?

Yes, collections are temporarily paused while your application is under review.

5. What happens if my offer is rejected?

You can appeal or explore other IRS relief options, like installment plans or CNC status.

Key Takeaways

- The IRS debt relief form (Form 656) lets you request a debt reduction via Offer in Compromise.

- Eligibility depends on your financial situation and tax filing compliance.

- The form requires detailed financial information and an application fee.

- Collections pause during review, but approval is not guaranteed.

- Getting expert help can increase your chance of success.

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.Advertising. This site is a marketing service and does not provide legal or tax advice. Submitting information does not create an attorney-client, tax professional-client, or any other advisory relationship. Results are not guaranteed. A list of participating attorneys, tax firms, and tax providers is available here.

IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems

Recent Posts

- How to Get Innocent Spouse Relief | Navigate IRS Forms and Appeals

- Who Is Eligible for Innocent Spouse Relief and How Does It Work?

- What is an Effective Tax Strategy for Married Couples

- What are the Proofs of Innocent Spouse Relief?

- What Form Do You Use for an Innocent Spouse? | Complete IRS Filing Guide