Who Can Help With Tax Debt? Find the Right Support Today

Who Can Help With Tax Debt? Understanding Your Options

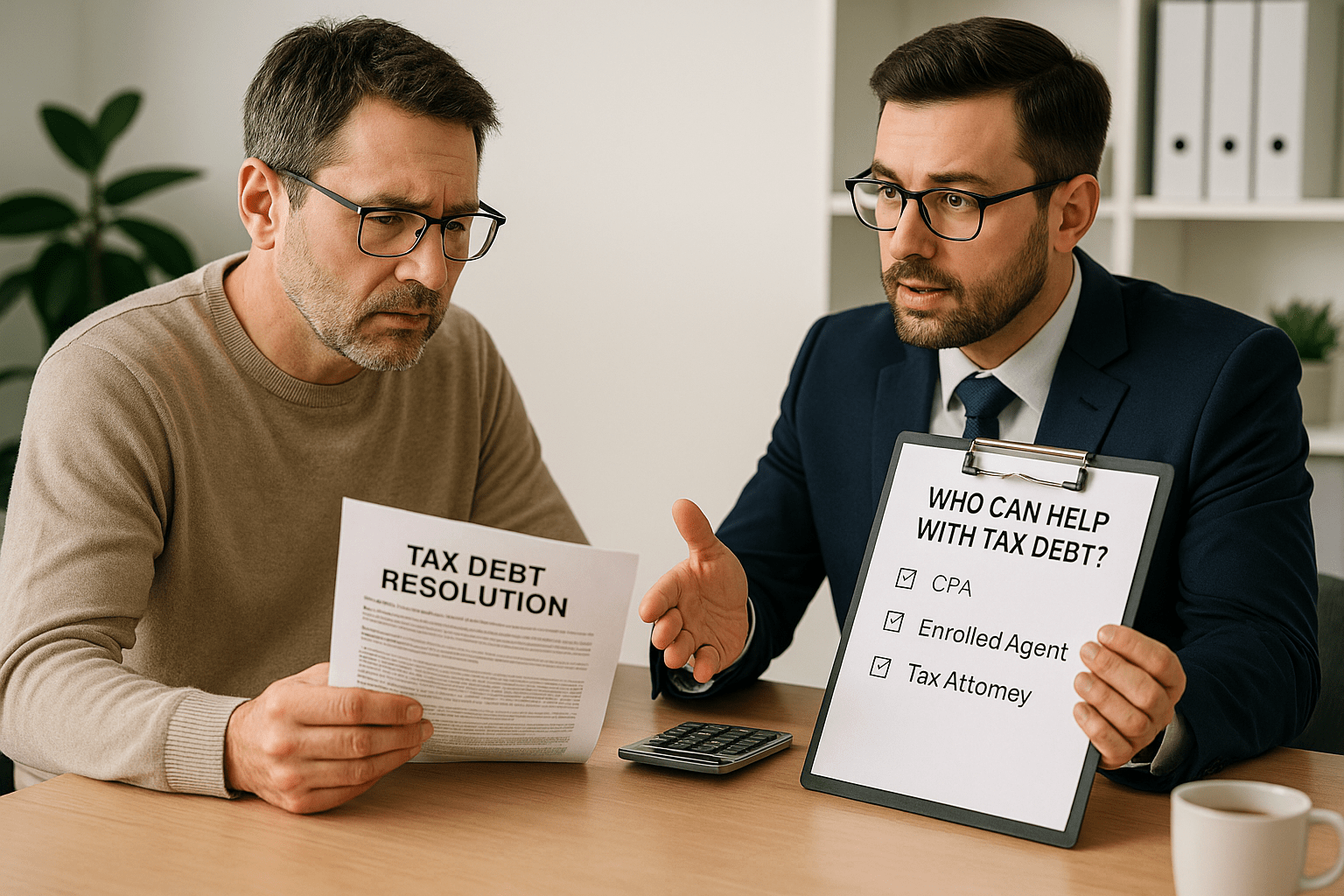

Who can help with tax debt when the IRS begins sending notices or threatening garnishments? If you’re dealing with unpaid taxes, penalties, or interest, you don’t have to face it alone. Several types of licensed professionals specialize in tax relief and can work with the IRS on your behalf. Getting the right help can save you time, money, and stress.

Tax Relief Professionals You Can Trust

Different professionals serve different roles in resolving tax issues. Knowing who does what will help you choose the right one based on your situation.

Enrolled Agents (EAs)

EAs are federally licensed by the IRS to represent taxpayers in audits, appeals, and collection matters. Many EAs work with tax relief companies and can:

- Negotiate installment agreements

- Apply for penalty abatement

- Submit Offers in Compromise (OIC)

Certified Public Accountants (CPAs)

CPAs are licensed at the state level and offer more than just tax filing services. Many are trained in IRS resolution strategies and can help with financial reviews, installment agreements, and penalty abatements.

Tax Attorneys

Tax attorneys specialize in legal IRS issues. They’re ideal for:

- IRS audits and Tax Court cases

- Defense in fraud or criminal tax matters

- Representation in litigation or advanced negotiations

Need help navigating legal or enforcement issues? Get legal tax support from vetted professionals.

How Tax Relief Companies Assist Taxpayers

Beyond individual professionals, many people choose to work with full-service tax relief companies that provide access to a team of experts.

Services Offered

A quality tax relief firm will:

- Communicate directly with the IRS on your behalf

- Help you apply for an Offer in Compromise (OIC)

- Set up Installment Agreements to pay your debt over time

- Request a Currently Not Collectible (CNC) status if you can’t afford payments

These services can reduce what you owe or temporarily stop collections while your case is reviewed.

Choosing a Reputable Company

To avoid scams, look for firms with:

- IRS certifications (such as authorized e-file providers)

- A positive Better Business Bureau (BBB) rating

- Transparent fees and no “guaranteed” outcomes

Be wary of companies promising to eliminate all your tax debt without reviewing your situation first.

When to Contact a Tax Professional

If you’re asking who can help with tax debt, timing is critical. Waiting too long can make things worse.

Signs You Need Help

- You owe more than $10,000 in back taxes

- You’ve received IRS collection letters or threats of wage garnishment

- You’re unsure which IRS relief programs you qualify for

In any of these cases, it’s smart to consult a tax expert before the IRS escalates its actions.

Benefits of Early Professional Assistance

The sooner you get professional assistance, the more options you may have available for:

- Addressing penalties and interest

- Responding to collection actions

- Exploring settlement or payment plan options

What to Expect During the Relief Process

Working with a tax professional starts with a review of your finances and ends with a customized plan for resolving your debt.

Initial Consultation

Most professionals offer a free or low-cost consultation. During this meeting, they’ll:

- Review your IRS letters or account transcript

- Calculate your total tax liability

- Explain your relief options

Documentation & Negotiation

You’ll be asked to provide documents like:

- Income and expense details

- Previous tax returns

- Proof of hardship (if requesting special relief)

Your tax expert will then negotiate directly with the IRS and work to pause collections during the review period.

Knowing Who Can Help With Tax Debt Can Make All the Difference

When you’re overwhelmed by notices or penalties, knowing who can help with tax debt can give you peace of mind. Whether you choose a CPA, an Enrolled Agent, or a tax attorney, professional guidance ensures you won’t navigate IRS bureaucracy alone—and may even lower the amount you owe.

Get Expert Help With Tax Debt Before It Escalates

Still wondering who can help with tax debt? Don’t wait for the IRS to take action. Get help from licensed tax professionals or trusted relief services who understand the system and can advocate on your behalf.

Start today at Tax Debt Lawyer and take the first step toward resolving your IRS debt with clarity and confidence.

Frequently Asked Questions

1. Who is best qualified to help with IRS debt?

Enrolled Agents, CPAs, and tax attorneys all have the training to help, depending on the complexity of your situation.

2. Can tax relief companies really reduce my debt?

Yes, in some cases. They can help you apply for programs like the Offer in Compromise, but approval depends on IRS rules.

3. When should I contact a tax attorney instead of a CPA?

If you’re facing legal action, tax fraud allegations, or high-stakes disputes, a tax attorney is best.

4. How much does tax debt relief usually cost?

Costs vary, but most firms offer initial consultations. Be cautious of large upfront fees and read contracts carefully.

5. Is it safe to work with tax debt relief firms online?

Yes, if they’re accredited and have strong online security practices. Always verify their credentials before sharing sensitive data.

Key Takeaways

- Who can help with tax debt? Enrolled Agents, CPAs, attorneys, and tax relief companies.

- Each offers unique skills, from negotiation to legal representation.

- Tax professionals can reduce debt, stop collections, and prevent garnishments.

- Early intervention leads to better outcomes and fewer penalties.

- Always verify a provider’s credentials before committing.

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.Advertising. This site is a marketing service and does not provide legal or tax advice. Submitting information does not create an attorney-client, tax professional-client, or any other advisory relationship. Results are not guaranteed. A list of participating attorneys, tax firms, and tax providers is available here.

IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems

Recent Posts

- How to Get Innocent Spouse Relief | Navigate IRS Forms and Appeals

- Who Is Eligible for Innocent Spouse Relief and How Does It Work?

- What is an Effective Tax Strategy for Married Couples

- What are the Proofs of Innocent Spouse Relief?

- What Form Do You Use for an Innocent Spouse? | Complete IRS Filing Guide