Where Tax Dollars Go: A Breakdown of Government Spending

Where Tax Dollars Go: Understanding Federal and Local Use

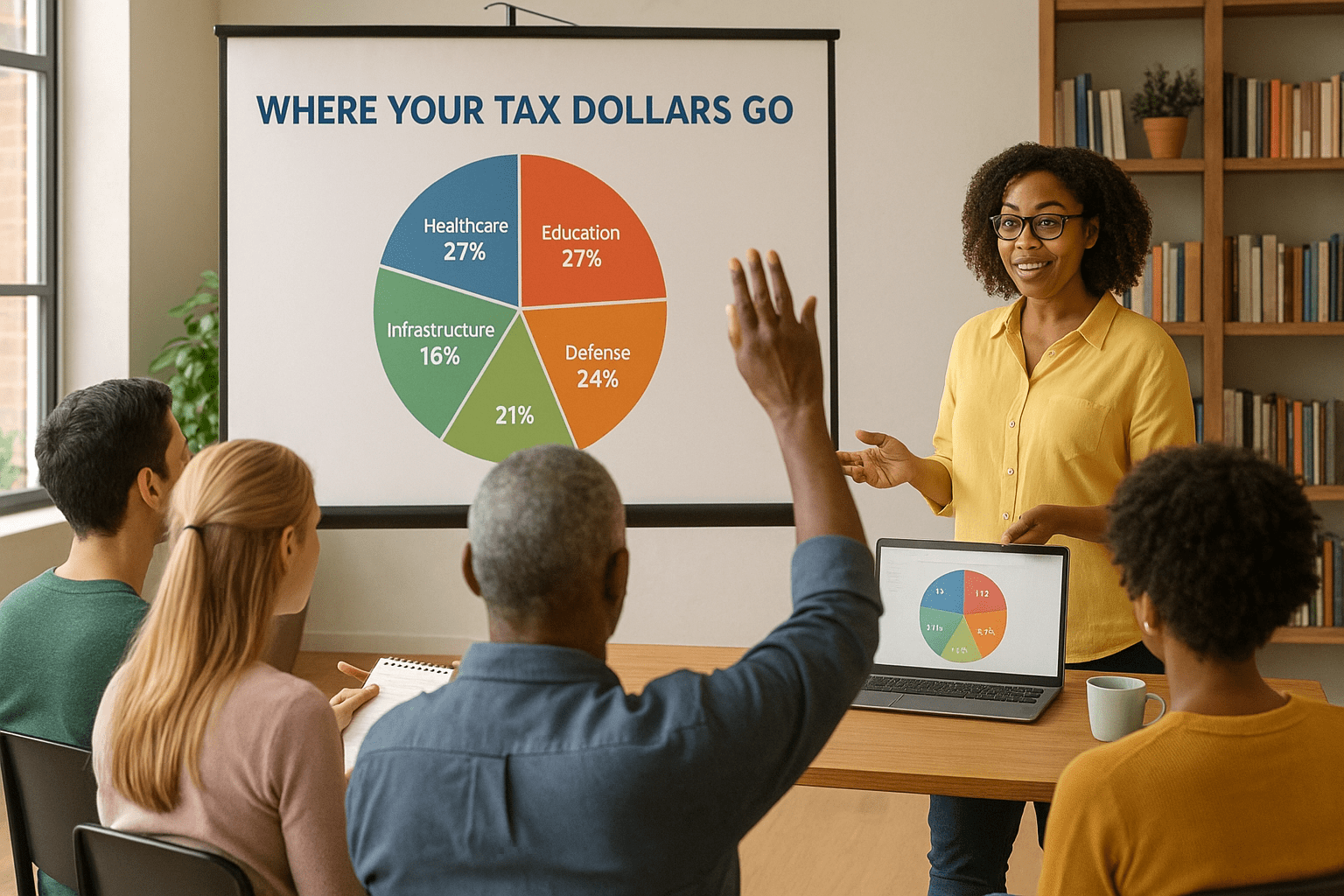

Where tax dollars go is a question many Americans ask each year, especially during tax season. Taxes are a civic duty—but they’re also an investment in the infrastructure, safety, and services we all rely on. From national defense and education to social services and transportation, here’s how your tax dollars are put to use.

Federal Spending—The Big Picture

The federal government collects income taxes from individuals and businesses and uses those funds to support nationwide programs. Here’s where much of it goes:

Social Security and Medicare

A large portion of your taxes goes directly to funding Social Security benefits and Medicare. These programs support retirees, disabled individuals, and older Americans needing healthcare coverage.

National Defense and Veterans’ Programs

The U.S. spends a significant share on defense, funding the military, national security operations, and support for veterans through healthcare and housing.

Interest on the National Debt

The government borrows money to cover budget shortfalls. Interest payments on this debt are a required part of annual spending and consume hundreds of billions annually.

State and Local Spending Differences

While the federal government handles national programs, your state and local taxes support services closer to home.

Public Education Funding

State and local governments pay for the majority of K–12 public school expenses, including teacher salaries, school maintenance, and curriculum development.

Infrastructure, Roads, and Public Safety

From pothole repairs to law enforcement, fire departments, and public transit, local tax dollars keep your community safe and functioning.

Healthcare and Welfare Programs

Medicaid and other public assistance programs are funded at both the federal and state levels, helping low-income families and individuals access vital services.

How Taxes Are Collected and Allocated

Your tax burden isn’t just one lump sum—different taxes fund different levels of government.

Federal vs. State and Local Taxes

Federal income taxes go to the IRS, while you may also pay state income taxes, sales taxes, and property taxes, depending on where you live. If you’re concerned about how your income tax is affecting your budget, you may benefit from exploring IRS tax relief options.

Discretionary vs. Mandatory Spending

Mandatory spending (like Medicare and Social Security) is required by law. Discretionary spending (like education and defense) is debated and set by Congress each year.

Annual Budget Process

Each year, the government creates a budget that outlines how tax revenue will be distributed. Departments like Health and Human Services or the Department of Education receive funding based on this process.

Common Misconceptions About Where Tax Dollars Go

There are a few myths that cloud public understanding of tax allocation.

Overestimating Foreign Aid

Many people believe foreign aid is a huge part of the budget. In reality, it accounts for less than 1% of federal spending.

Misunderstanding Social Program Costs

Programs like SNAP or housing assistance often face criticism, but they consume far less of the budget than Social Security, Medicare, or defense.

Military Spending Myths

Defense remains a large share of discretionary spending, but its percentage of the overall budget has decreased over the last few decades.

Know Where Your Tax Dollars Go and Why It Matters

Understanding where tax dollars go helps you become a more informed and engaged citizen. Whether you’re voting on local bonds or evaluating federal policies, knowing how money is allocated empowers you to make smarter civic decisions. Taxes may not be popular, but when used effectively, they support a society that functions better for everyone.

Learn More About Taxes and Government Spending

Want to better understand how your taxes are used or how you can make smarter financial decisions during tax season? Contact us to speak with a licensed tax professional. We can help you navigate your tax obligations, understand deductions, and find relief options tailored to your needs.

Frequently Asked Questions (FAQs)

1. What is the largest category of federal spending?

Social Security is the largest single category, followed closely by Medicare and Medicaid.

2. How much of my taxes go to defense?

Roughly 12–15% of the federal budget is allocated to defense spending, depending on the year.

3. Do state taxes go toward federal programs?

No. State taxes are managed separately and fund state-specific services like education, roads, and local law enforcement.

4. Can taxpayers influence how their taxes are spent?

Yes. Voting in elections, attending local council meetings, and contacting elected officials are key ways to influence budget decisions.

5. What happens if tax revenue falls short of budget needs?

The government may borrow money, reduce services, or increase taxes to cover the shortfall.

Key Takeaways

- Where tax dollars go depends on how the government allocates federal, state, and local budgets.

- Federal taxes support programs like Social Security, Medicare, and defense.

- State and local taxes fund schools, infrastructure, and emergency services.

- Misconceptions about spending can impact public understanding and policy support.

- Learning how tax dollars are spent improves civic awareness and financial literacy.

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.Attorney Advertising. This site is a legal marketing service and does not provide legal advice. Submitting information does not create an attorney-client relationship. Results are not guaranteed.

IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems

Recent Posts

- What Qualifies for Innocent Spouse Relief? | Understanding IRS Eligibility Requirements

- What Is Innocent Spouse Relief | Complete Guide to IRS Tax Debt Relief Options

- Innocent Spouse Relief | A Legal Guide to IRS Tax Debt Relief Options

- How Long Will the IRS Give You to Pay Your Taxes | Understanding Your Payment Options

- What Is the 600 Rule in the IRS | How Does It Affect Your Taxes?