IRS Debt Forgiveness: A Complete Guide to Tax Relief Options

IRS Debt Forgiveness: Understanding Your Options for Relief

IRS debt forgiveness is a program that allows qualifying taxpayers to reduce or eliminate the amount they owe to the Internal Revenue Service (IRS). If you are struggling with unpaid taxes, IRS debt forgiveness could offer a real solution for gaining control over your finances. Along with other options like IRS tax relief and IRS back taxes help, these programs are designed to help individuals and businesses resolve outstanding debts and avoid severe penalties.

In this article, we will walk you through what IRS debt forgiveness is, who qualifies, the available programs, and how to get started. Whether you’re facing serious tax debt or just want to better understand your options, this guide will provide simple, step-by-step information to help you explore available options.

What Is IRS Debt Forgiveness?

IRS debt forgiveness is a program that allows taxpayers to settle their outstanding tax debt for less than the full amount they owe. If you cannot afford to pay your full tax balance, the IRS offers several options to either reduce your debt, delay payment, or sometimes eliminate it completely. These programs are designed to help people who are facing serious financial hardship and cannot meet their tax obligations.

It’s important to understand that IRS debt forgiveness is not the same as IRS tax relief or IRS debt relief. While they are related, they serve slightly different purposes. IRS tax relief is a broader term that refers to any program or policy designed to ease the financial burden of paying taxes. This can include deductions, credits, and payment plans. On the other hand, IRS debt relief specifically targets taxpayers who already owe back taxes and need help resolving their debt through negotiation or settlement programs.

In short, IRS debt forgiveness is one type of debt relief focused on helping taxpayers who owe the IRS more than they can reasonably pay. It offers a fresh start for those who qualify, giving them a way to resolve their debt without being buried by overwhelming payments.

Who Qualifies for IRS Debt Forgiveness?

Not everyone will qualify for IRS debt forgiveness, but the IRS does offer options for taxpayers who are truly struggling. To be eligible, you must usually show that paying your full tax debt would create a serious financial hardship. The IRS considers your income, expenses, assets, and overall financial situation before approving any form of debt forgiveness.

Generally, you may qualify for IRS debt forgiveness if:

- Your income is too low to cover basic living expenses and pay your tax debt.

- You have little to no valuable assets that could be sold to pay your taxes.

- You are facing serious financial hardship, such as unemployment, medical emergencies, or other unavoidable expenses.

The IRS uses strict income guidelines and financial analysis tools when reviewing forgiveness applications. If your disposable income is very limited, you may have a better chance of qualifying. In many cases, working with a professional who understands IRS tax negotiation can provide guidance through the application process. To find out if you qualify, complete the short form on this page or call the number provided to speak with a tax relief specialist today.

If you owe IRS back taxes and believe you might qualify, it’s important to act quickly. Programs like the Offer in Compromise (OIC) or Currently Not Collectible (CNC) status are not automatic — you must apply and provide detailed financial information. Seeking IRS back taxes help from experienced professionals can provide assistance with preparing and submitting paperwork.

IRS Debt Forgiveness Programs Explained

The IRS offers several programs under its IRS debt forgiveness options to help taxpayers find relief. Each program is designed for different financial situations, and choosing the right one can make a big difference. Let’s explore the most common types of IRS debt relief programs available today.

Offer in Compromise (OIC)

An Offer in Compromise allows you to settle your tax debt for less than the total amount you owe. This program is ideal for individuals who genuinely cannot pay their full tax bill without financial hardship. The IRS reviews your income, expenses, assets, and future earning potential to determine if they can accept a lower amount.

An OIC is considered one of the most powerful forms of IRS tax relief because it can significantly reduce your debt. However, it’s important to note that the IRS accepts only a small percentage of offers submitted. Getting professional help with your application can provide guidance on requirements and documentation.

Currently Not Collectible (CNC) Status

If you’re facing extreme financial hardship, you might qualify for Currently Not Collectible (CNC) status. This means the IRS temporarily pauses all collection efforts against you, such as wage garnishments, levies, or liens.

While CNC status does not erase your debt, it gives you breathing room until your financial situation improves. The IRS will periodically review your case to see if your ability to pay has changed. For many struggling taxpayers, CNC status offers vital IRS debt relief during tough times.

IRS Installment Agreements

Sometimes, paying your full tax debt is possible, but not all at once. In this case, an IRS Installment Agreement allows you to pay off your debt over time through monthly payments.

There are several types of Installment Agreements depending on how much you owe. These agreements are a popular form of IRS tax relief because they make it easier to manage large tax bills without facing aggressive collection actions. Although you will still owe penalties and interest while on a payment plan, it prevents the IRS from taking more serious enforcement steps against you.

Penalty Abatement Programs

The IRS charges penalties for things like filing late, paying late, or not filing at all. These penalties can add up quickly and make your total debt much higher than the original tax amount. Penalty Abatement Programs offer a way to reduce or eliminate some of these extra charges.

You might qualify for penalty relief if you have a good payment history or can show reasonable cause for falling behind. Examples include serious illness, natural disasters, or unexpected hardships. Reducing penalties is another valuable form of IRS debt relief that can significantly lower the amount you ultimately need to pay.

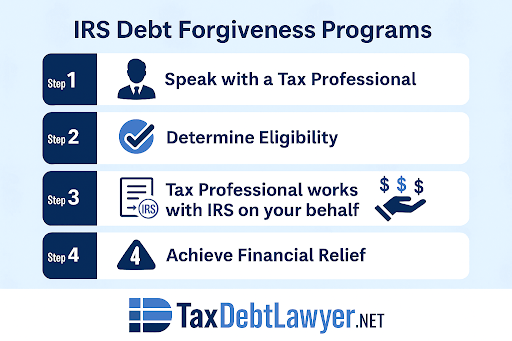

How to Apply for IRS Debt Forgiveness

Applying for IRS debt forgiveness can seem overwhelming, but breaking it down into simple steps makes the process easier to manage. Here’s a clear guide to help you start:

Step 1: Review Your Financial Situation

Before you apply, take a close look at your income, expenses, assets, and debts. The IRS will ask for detailed financial information, so it’s important to have everything ready. Being honest and organized from the start can save you time and stress.

Step 2: Choose the Right IRS Debt Forgiveness Program

Decide which program fits your situation:

- If you cannot afford to pay most of what you owe, an Offer in Compromise might be right.

- If you can pay but need time, an Installment Agreement could help.

- If you have no ability to pay right now, you may qualify for Currently Not Collectible status.

- If penalties are your biggest problem, consider Penalty Abatement options.

Understanding your options is key to finding the right path to IRS debt relief.

Step 3: Gather the Correct Forms

The IRS requires specific forms depending on the program you are applying for:

- Offer in Compromise: Form 656 and Form 433-A (OIC)

- Installment Agreement: Form 9465

- Currently Not Collectible: Financial statement forms like Form 433-F

Make sure you complete all forms accurately and provide any requested documentation, such as pay stubs, bank statements, or bills.

Step 4: Submit Your Application

Send your completed forms and supporting documents to the IRS. Some programs also require a small application fee or initial payment when you apply. Be sure to read the instructions carefully to avoid mistakes that could delay your application.

Step 5: Respond Promptly to IRS Requests

After you submit your application, the IRS may ask for more information. Respond quickly and completely. If you ignore their requests, your application could be denied.

Step 6: When to Seek IRS Tax Negotiation Help

While it’s possible to apply on your own, working with an experienced tax professional can make a big difference. If your case is complicated, if you owe a large amount, or if you’re unsure which program to choose, it’s smart to seek IRS tax negotiation assistance. Get the help you need—complete the form on this page or call now to speak with a qualified tax expert who can guide you through your options.

Tax attorneys, enrolled agents, and other tax professionals understand the IRS rules and can help you present your case in the best possible way. They can also negotiate directly with the IRS on your behalf and handle communications throughout the process.

Common Mistakes When Seeking IRS Debt Forgiveness

Applying for IRS debt forgiveness can open the door to major financial relief—but making mistakes during the process can lead to delays, denials, or even bigger problems. Here are some of the most common mistakes people make when trying to settle their IRS debt, and how you can avoid them.

Not Providing Complete Financial Information

- One of the biggest mistakes is submitting incomplete or inaccurate financial information. The IRS reviews every detail of your income, expenses, and assets. If you leave out information or make errors, the IRS may reject your application or accuse you of trying to hide assets.

Choosing the Wrong Program

- Different IRS debt forgiveness programs are designed for different financial situations. Applying for the wrong program can waste valuable time and lead to a fast denial. For example, submitting an Offer in Compromise when you actually have the means to pay through an Installment Agreement will almost always result in rejection.

Ignoring IRS Deadlines

- When you apply for any form of IRS debt relief, the IRS will often request additional documents or financial updates. Missing these deadlines can cause your application to be closed or automatically denied. Always respond quickly and completely to IRS communications.

Underestimating the Complexity of the Process

- Many people believe they can quickly and easily handle their tax debt application on their own. While some cases are simple, most involve complex forms, financial calculations, and strict legal guidelines. Trying to navigate the process without the right knowledge can cost you valuable opportunities for IRS debt relief.

- This is why seeking IRS back taxes help from experienced professionals can make a big difference. Tax experts understand the system, know what the IRS looks for, and can help you prepare and present your case. They can also guide you through negotiations, assist with documentation, and represent you in IRS matters.

When You Should Get Professional Help

While some taxpayers may be able to manage a simple payment plan on their own, applying for IRS debt forgiveness is often more complicated than it seems. In many cases, getting professional help can make the difference between success and failure when dealing with the IRS.

If you owe a large amount in back taxes, have complicated financial records, or are applying for programs like an Offer in Compromise, it’s a smart idea to work with a tax professional. Tax attorneys, enrolled agents, and tax relief specialists have the training and experience needed to navigate IRS procedures and rules. They understand how to present your case, negotiate with the IRS, and assist with the application process.

Professional IRS tax relief services can also help if you are already facing serious IRS collection actions, like wage garnishments, bank levies, or property liens. They can step in quickly to halt these actions while negotiating a solution with the IRS on your behalf.

Another important reason to seek help is when you simply feel overwhelmed by the paperwork and requirements. Applying for IRS debt relief is not just about filling out forms; it requires a detailed financial analysis, documentation, and sometimes ongoing communication with IRS agents. Having a trusted professional by your side can provide guidance and representation throughout the process.

In short, if your tax situation is complicated or you feel uncertain about the process, professional help can be a wise investment. With the right support, you can navigate the IRS debt relief process and understand available options.

Start Your Path Toward IRS Debt Forgiveness Today

Finding real solutions for unpaid taxes may feel overwhelming, but IRS debt forgiveness programs offer a clear path toward financial recovery. Whether you qualify for an Offer in Compromise, an Installment Agreement, Currently Not Collectible status, or Penalty Abatement, there are real options available to help you manage or even eliminate your tax burden.

Understanding the different types of IRS debt relief is the first step. Choosing the right program based on your financial situation can make a major difference in your future. Whether you owe a few thousand dollars or are dealing with serious IRS back taxes, there are ways to find relief and avoid aggressive collection actions.

If you are unsure where to start, seeking help from tax professionals who specialize in IRS tax relief can give you the guidance and confidence you need. With the right support, you can navigate IRS procedures, prepare applications, and explore settlement options.

Don’t let unpaid taxes control your life. By taking action today, you can begin exploring IRS debt forgiveness options and available relief programs.

Frequently Asked Questions

1. How long does IRS debt forgiveness take?

The timeline for IRS debt forgiveness depends on the program you apply for and the complexity of your case. An Offer in Compromise, for example, can take anywhere from six months to over a year for the IRS to review and decide. Other options, like an Installment Agreement or Currently Not Collectible status, may be processed faster. Submitting complete and accurate information can help speed up the process.

2. Is IRS debt forgiveness real?

Yes, IRS debt forgiveness is real, but it is not guaranteed for everyone. The IRS has specific programs in place, such as the Offer in Compromise and penalty abatement, that can significantly reduce or eliminate tax debt for qualified applicants. However, the IRS only grants forgiveness when a taxpayer can show that paying the full amount would cause serious financial hardship.

3. How does IRS tax negotiation work?

IRS tax negotiation involves working with the IRS to reach an agreement on how your tax debt will be handled. This may include settling the debt for less than you owe, setting up an affordable payment plan, or requesting a temporary delay in collections. Professional tax negotiators or attorneys can assist you by presenting a strong case for relief and negotiating favorable terms on your behalf.

4. Can I apply for IRS debt relief by myself?

Yes, you can apply for IRS debt relief on your own by completing the appropriate IRS forms and submitting the necessary documentation. However, many taxpayers find the process challenging and choose to work with tax professionals who specialize in IRS tax relief. Professional help can increase your chances of approval and ensure that your case is presented clearly and accurately.

5. What happens if I don’t qualify for IRS debt forgiveness?

If you do not qualify for IRS debt forgiveness, there are still other options available. The IRS may allow you to enter into a long-term Installment Agreement or place your account into Currently Not Collectible status if you cannot pay immediately. Seeking IRS back taxes help from a qualified professional can help you find the best alternative solution based on your financial situation.

Key Takeaways

- IRS debt forgiveness programs offer real solutions for taxpayers who cannot pay their full tax debt due to financial hardship.

- Several options are available, including Offer in Compromise, Installment Agreements, Currently Not Collectible status, and Penalty Abatement programs.

- Applying for IRS debt relief requires detailed financial information, the right forms, and careful attention to deadlines and IRS requirements.

- Working with professionals who specialize in IRS tax relief and IRS tax negotiation can greatly improve your chances of securing favorable outcomes.

- Even if you don’t qualify for full IRS debt forgiveness, other programs can still help you manage, reduce, or delay your tax payments to regain financial stability.

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.Attorney Advertising. This site is a legal marketing service and does not provide legal advice. Submitting information does not create an attorney-client relationship. Results are not guaranteed.

IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems

Recent Posts

- If I Owe the IRS But Can’t Afford to Pay: Your Relief Options

- Who Qualifies for the IRS Hardship Program: Understanding Currently Non-Collectible Status

- What Debts Qualify for the Fresh Start Program: Eligible Debt Checklist

- What Happens If You Owe the IRS More Than $25,000: Your Tax Relief Options

- IRS Tax Debt Relief Eligibility: Complete Guide to Qualifying for Tax Resolution Programs