IRS Audit

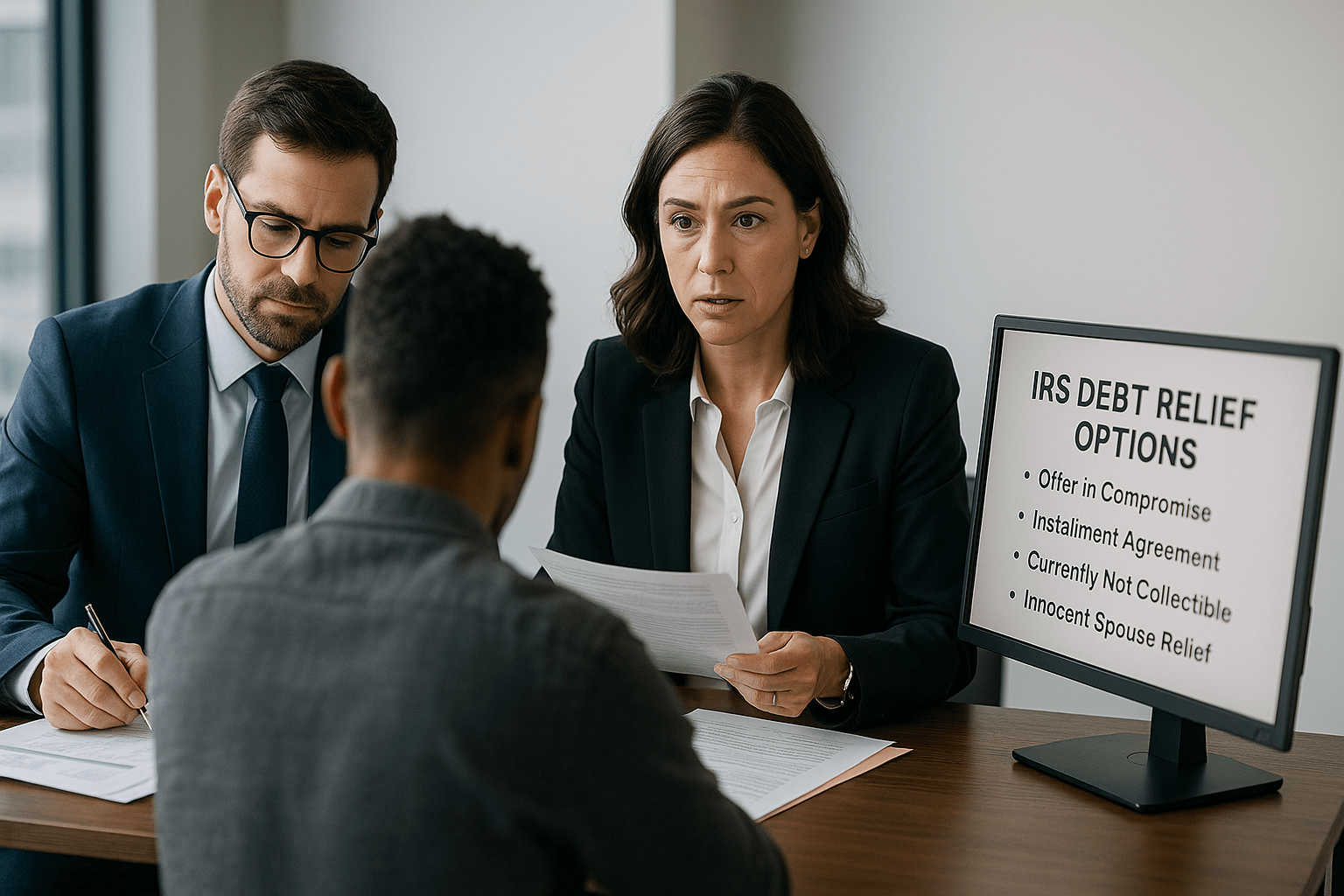

Who Can Help With IRS Debt and What Type of Help You Need Who can help with IRS debt when collection letters, penalties, and interest start piling up? Many Americans face this question every year—and thankfully, there are reliable answers. Whether you need to file late returns, negotiate a payment plan, or settle your balance, […]

IRS Auditing Explained An audit from the Internal Revenue Service (IRS) can be a substantial interruption to your life. The complexities of tax law are not a concern for most people, but once that audit notice is received, you have a responsibility to the IRS and to yourself to respond appropriately. There’s no need to […]

How to Respond to an IRS Notice Receiving an official notice from the Internal Revenue Service (IRS) can be a frightening experience, but don’t panic! Responding to an IRS notice doesn’t have to be a nerve-wracking experience. With a clear understanding of the process and the assistance of a qualified tax attorney, you can navigate […]

What Are the Chances I Could Be Audited by the IRS? The likelihood of being audited by the IRS (Internal Revenue Service) depends on several factors, including the type of tax return you filed, the deductions you claimed, your income level, and other information on your return. In general, the overall audit rate for individual […]