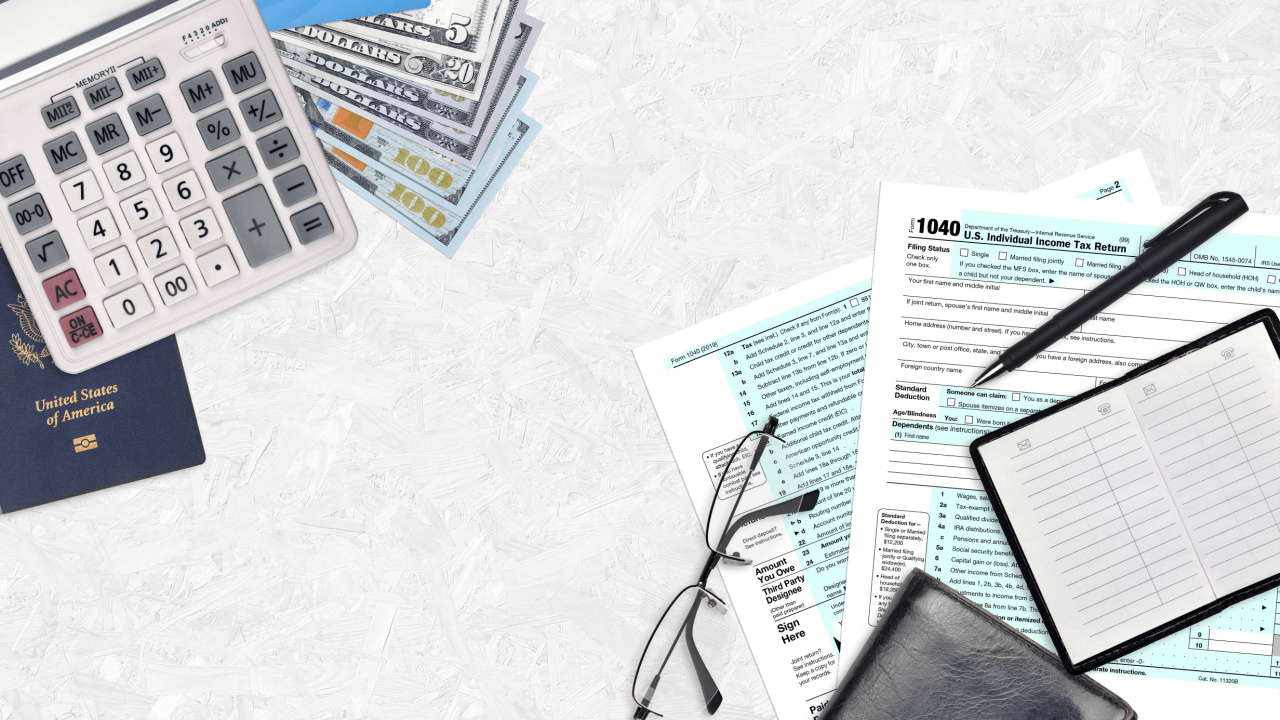

Approval Strategy: IRS Settlement and Offer in Compromise An IRS settlement and offer in compromise allows eligible taxpayers to resolve tax debt for less than the full amount owed. The IRS reviews Offer in Compromise applications based on statutory and financial criteria. Providing qualified individuals and businesses with substantial debt relief. This comprehensive guide explains […]

Tax Relief Preview: Who Qualifies for the IRS Fresh Start Who qualifies for the IRS Fresh Start program depends on your tax debt amount, income level, and payment history. Taxpayers owing less than $50,000 in combined tax, penalties, and interest may wish to speak with a licensed attorney to discuss whether they qualify for installment […]

Clearing Debt: How to Clear $30,000 Debt Fast How to clear 30000 debt fast starts with IRS payment plans, Offer in Compromise programs, or Currently Not Collectible status. The IRS processes approximately 40,000 Offer in Compromise submissions annually. With the right tax relief approach, most taxpayers can resolve substantial debt within 12-72 months through structured […]

Program Insight: How Many Years Does It Take for IRS Debt to Be Forgiven How many years does it take for IRS debt to be forgiven? The IRS has 10 years from the assessment date to collect tax debt under the Collection Statute Expiration Date (CSED). After this period expires, the IRS must stop collection […]

Statute Timeline Insight: What Is the IRS 7-Year Rule What is the IRS 7 year rule? While many taxpayers confuse this with the 10-year Collection Statute Expiration Date, the “7 year rule” typically refers to IRS penalty assessments expiring after 7 years and the audit statute of limitations. The IRS generally has 10 years to […]

Financial Hardship: What Happens if You Lose Your Job and Can’t Pay Taxes What happens if you lose your job and can’t pay your bills? You may face tax debt accumulation, IRS penalties, and collection actions—but relief programs exist. The IRS reports that approximately 15.6 million Americans experience tax filing compliance issues during financial hardship, […]

Key Differences: Tax Attorney vs Enrolled Agent Overview Understanding the distinction between a tax attorney vs enrolled agent is crucial when seeking professional tax help. Both professionals can represent you before the IRS, but they offer different qualifications, services, and pricing structures that impact your decision. When facing tax problems, the choice between a tax […]

Debt Forgiveness: IRS Debt Forgiveness Programs IRS debt forgiveness programs offer legitimate pathways to resolve tax debt through offers in compromise, penalty abatement, currently not collectible status, and structured payment plans. According to IRS data, approximately 40% of offer in compromise applications are accepted annually, with average settlements reducing debt by 90% for qualified taxpayers. […]

Expert Definition: Tax Attorney for IRS Debt Relief Services A tax attorney for IRS debt relief provides specialized legal representation for taxpayers facing significant tax obligations. These qualified professionals negotiate with the IRS, implement debt resolution strategies, and protect client rights throughout the process. When you owe back taxes, hiring a tax attorney for IRS […]

Immediate Relief Available: Tax Attorney for Wage Garnishment Solutions When the IRS starts garnishing your wages, hiring a tax attorney for wage garnishment becomes your most powerful defense. A qualified tax attorney can immediately halt wage garnishment proceedings while negotiating a favorable resolution to your tax debt. The IRS can legally take up to 25% […]