0 Debt to Income Ratio: Financial Implications Explained 0 debt to income ratio might sound like the ultimate financial goal—but is it always a good thing? This ratio, used by lenders and financial professionals, can affect your ability to borrow money, build credit, or qualify for major purchases. Knowing what it really means is key […]

What Happens After Death: Does Tax Debt Get Passed Down Does tax debt get passed down to family members when someone dies? It’s a common concern for individuals trying to protect their loved ones from financial hardship. While most debts don’t simply vanish after death, the good news is that heirs usually aren’t personally responsible, […]

IRS Debt Cancellation Form: Understanding Its Purpose IRS debt cancellation form is a common term used when taxpayers receive a notice about canceled debt. While it may sound like a tool for eliminating IRS debt, it actually refers to IRS Form 1099-C, which reports debt that has been forgiven or discharged by a creditor. Knowing […]

Understanding the Impact: Does Tax Debt Go on Your Credit Report Does tax debt go on your credit report if you owe the IRS or state taxes? Many people are surprised to learn that the answer is not as straightforward as it once was. While tax debt used to affect your credit score more directly, […]

Understanding the Decision: IRS Banned Debt Collectors IRS banned debt collectors after mounting criticism and concerns about taxpayer abuse. For years, the IRS outsourced some of its overdue tax accounts to private collection agencies. But those partnerships created more problems than solutions. In 2024, the IRS made a major shift—banning the use of third-party debt collectors […]

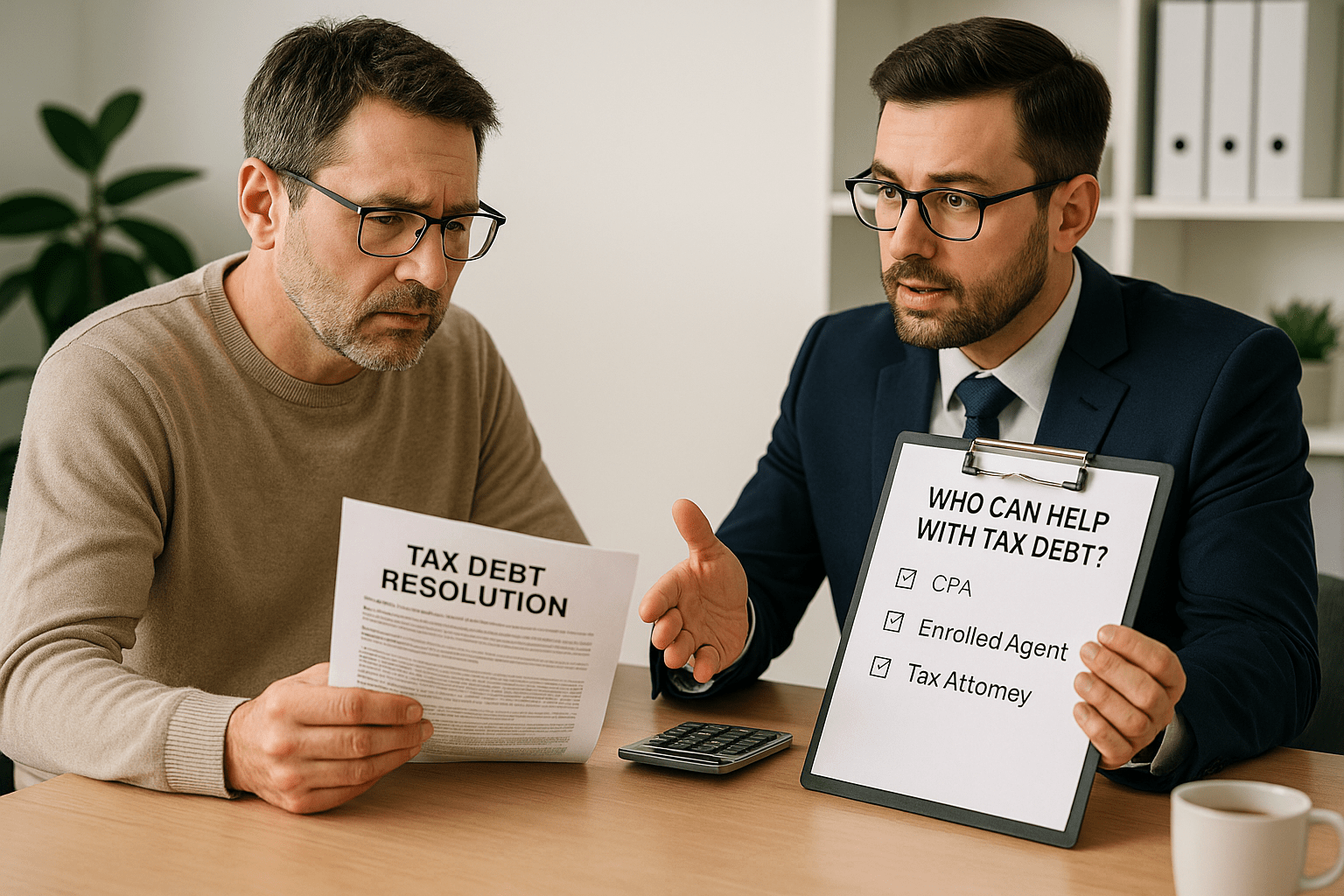

Who Can Help With Tax Debt? Understanding Your Options Who can help with tax debt when the IRS begins sending notices or threatening garnishments? If you’re dealing with unpaid taxes, penalties, or interest, you don’t have to face it alone. Several types of licensed professionals specialize in tax relief and can work with the IRS […]

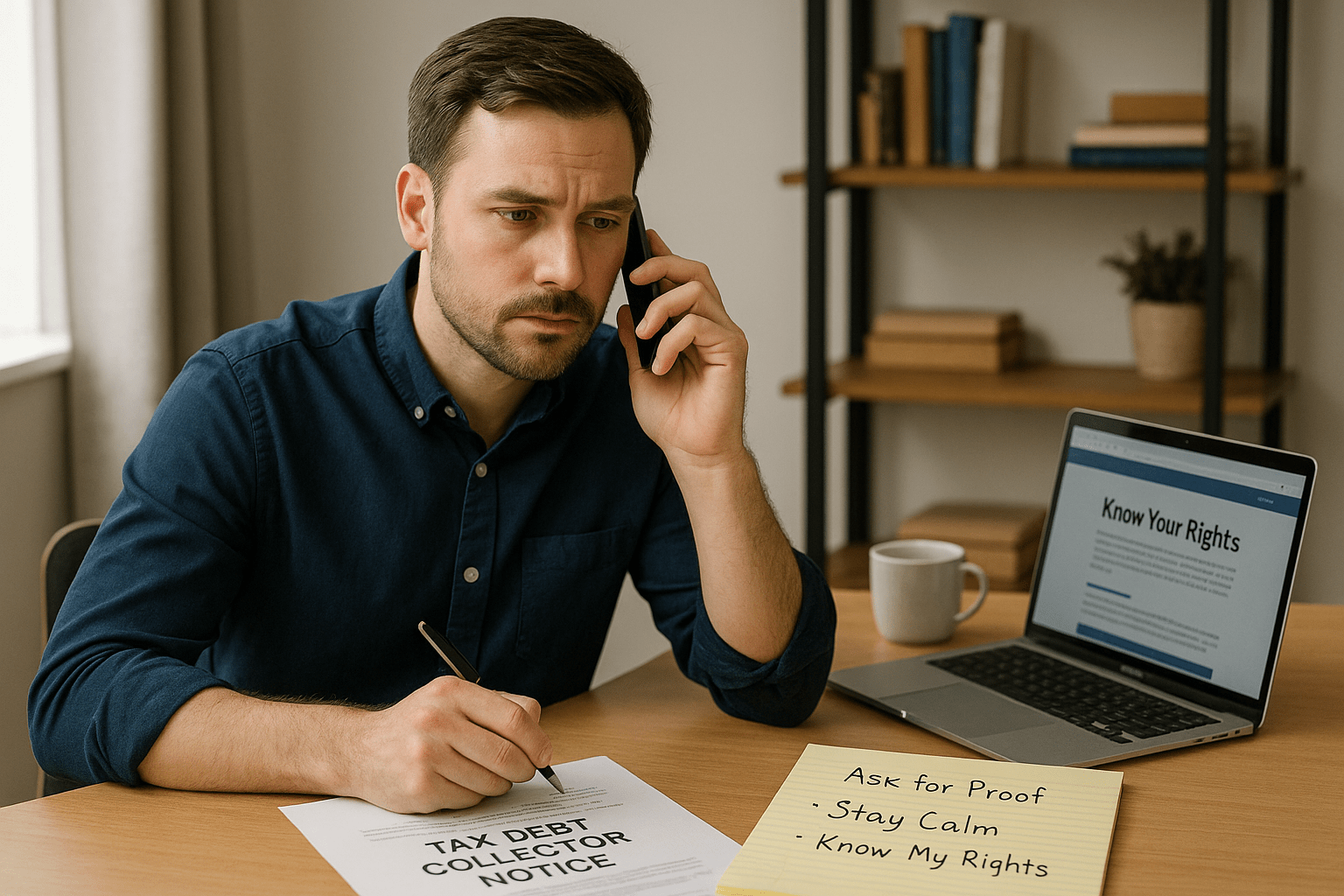

How They Work and What to Expect: Tax Debt Collector Tax debt collector calls and letters can be overwhelming, especially if you’re unsure whether they’re legitimate or how to respond. The good news is that you have rights—and knowing how these collectors operate can help you take control of the situation. Whether the IRS is […]

What Happens After Death: Does IRS Debt Pass to Next of Kin Does IRS debt pass to next of kin when a taxpayer dies? It’s a common concern for families handling a loved one’s final affairs. The short answer is no—IRS debt does not automatically transfer to surviving relatives. However, the IRS can still collect […]

Exploring the 10-Year Statute of Limitations: Do IRS Debts Expire Do IRS debts expire? Yes, under certain conditions, IRS tax debt is subject to a 10-year statute of limitations. This means the IRS typically has 10 years from the date of tax assessment to collect what you owe. However, there are important exceptions and events that […]

Understanding When IRS Bad Debt Guidelines Allow Deductions IRS bad debt guidelines provide a clear framework for determining when you can write off unpaid debts on your tax return. If you’ve loaned money, sold goods, or offered services that were never paid for, the IRS allows certain bad debts to be deducted—if they meet specific […]