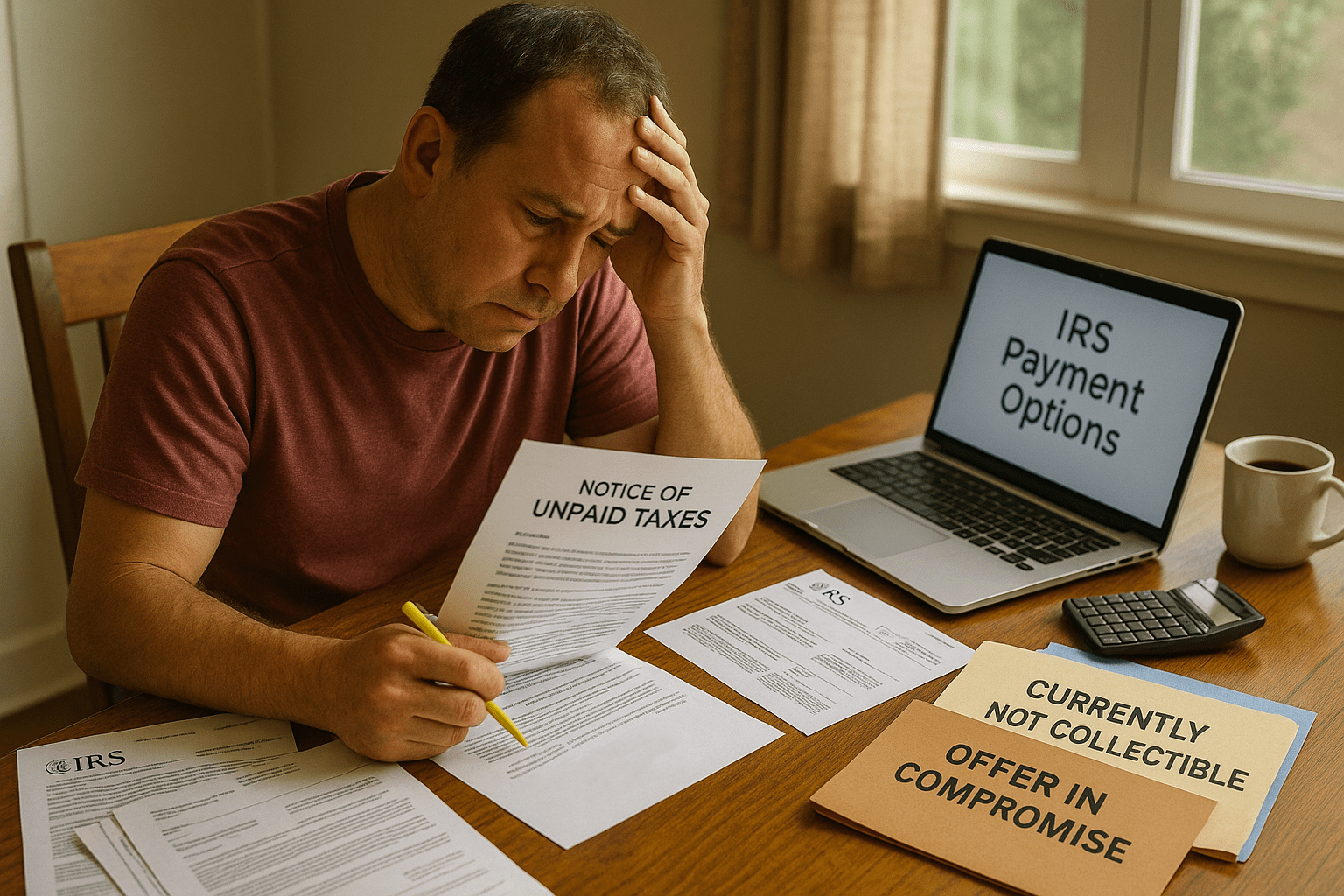

Understanding IRS Debt Uncollectible Status and Financial Hardship IRS debt uncollectible status is a temporary solution for taxpayers facing severe financial hardship. When granted, this status tells the IRS to pause collection efforts—like wage garnishment or bank levies, because you currently lack the ability to pay. While it doesn’t erase your tax debt, it provides […]

What Is a Tax Debt Line and Why Does It Matter? A tax debt line is a key entry in your IRS records that shows how much you currently owe, including taxes, penalties, and interest. Found on your IRS account transcript or tax statement, this line gives you a clear view of your total tax […]

Understanding What Kind of Debt Can the IRS Take Your Refund For What kind of debt can the IRS take your refund for? If you’re expecting a tax refund but owe certain types of federal or state debts, the IRS may withhold some or all of your return through a process called the Treasury Offset […]

IRS Gov Debt Forgiveness Form: Understanding IRS Form 982 The IRS gov debt forgiveness form, officially known as IRS Form 982, allows eligible taxpayers to reduce or eliminate tax liability on canceled debt. When you settle a debt for less than the amount owed, the IRS may treat the forgiven portion as taxable income. However, […]

How Does IRS Debt Tax Relief Work? IRS debt tax relief can offer much-needed help for people overwhelmed by back taxes. If you’re unable to pay the full amount, the IRS has programs that may reduce, pause, or restructure your debt to make it more manageable. What Is IRS Debt Tax Relief? IRS debt tax […]

Understanding IRS Debt: What It Is and Why It Happens IRS debt can feel overwhelming, especially if you’re facing penalties, interest, or collection notices. But with the right strategy, it is possible to resolve your tax issues and protect your finances. Every year, many Americans find themselves owing money to the IRS due to missed […]

How Can I Settle My Tax Debt with the IRS? If you’re asking, “How can I settle my tax debt?”—you’re not alone. Every year, many Americans struggle with unpaid taxes and look for legitimate ways to reduce or eliminate their debt. Fortunately, the IRS provides several programs that allow qualifying taxpayers to settle their debts […]

When Is Tax Debt Uncollectible According to the IRS? Tax debt uncollectible status can offer temporary relief when you simply cannot afford to pay what you owe. The IRS may determine that trying to collect from you would create a financial hardship. In this case, your tax debt is labeled as “Currently Not Collectible” (CNC), […]

IRS Gov Debt Forgiveness: How the Program Works IRS gov debt forgiveness allows qualifying taxpayers to reduce or settle their federal tax debt when full repayment isn’t financially possible. These programs can offer a lifeline to those experiencing financial hardship by helping them avoid collections, interest, and wage garnishments. But understanding how IRS forgiveness works—and […]

How They Help Taxpayers: IRS Debt Consolidation Companies IRS debt consolidation companies help individuals who are overwhelmed by back taxes and penalties. If you’re struggling to manage multiple IRS debts or can’t pay your balance in full, these companies offer structured, professional solutions. They work on your behalf to consolidate what you owe and set […]