Understanding the IRS Debt Number and Why It Matters The IRS debt number is the fastest way to connect with an IRS representative when you’re dealing with unpaid taxes. Whether you’ve received a notice or simply want to understand your options, calling the right number can help you take control of your tax situation. In […]

What Does It Mean to Get Help with IRS Debt? Help with IRS debt is available to those who feel overwhelmed by tax bills, penalties, or IRS collection actions. In this article, you’ll learn the most effective ways to resolve tax issues and find lasting financial relief. Common Reasons People Need Help with IRS Debt […]

Understanding How to Manage and Resolve My Tax Debt My tax debt is growing, and I don’t know where to start. If that’s how you feel, you’re not alone. Each year, thousands of Americans fall behind on their taxes, whether from underpayment, missed filings, or unexpected IRS notices. The good news? The IRS offers several […]

Understanding Whether IRS Debt Is Forgiven at Death Is IRS debt forgiven at death? This is a common question families face when settling the estate of a deceased loved one. The answer isn’t always straightforward. While IRS debt doesn’t automatically disappear, it also doesn’t always transfer to family members. Let’s explore what happens to tax […]

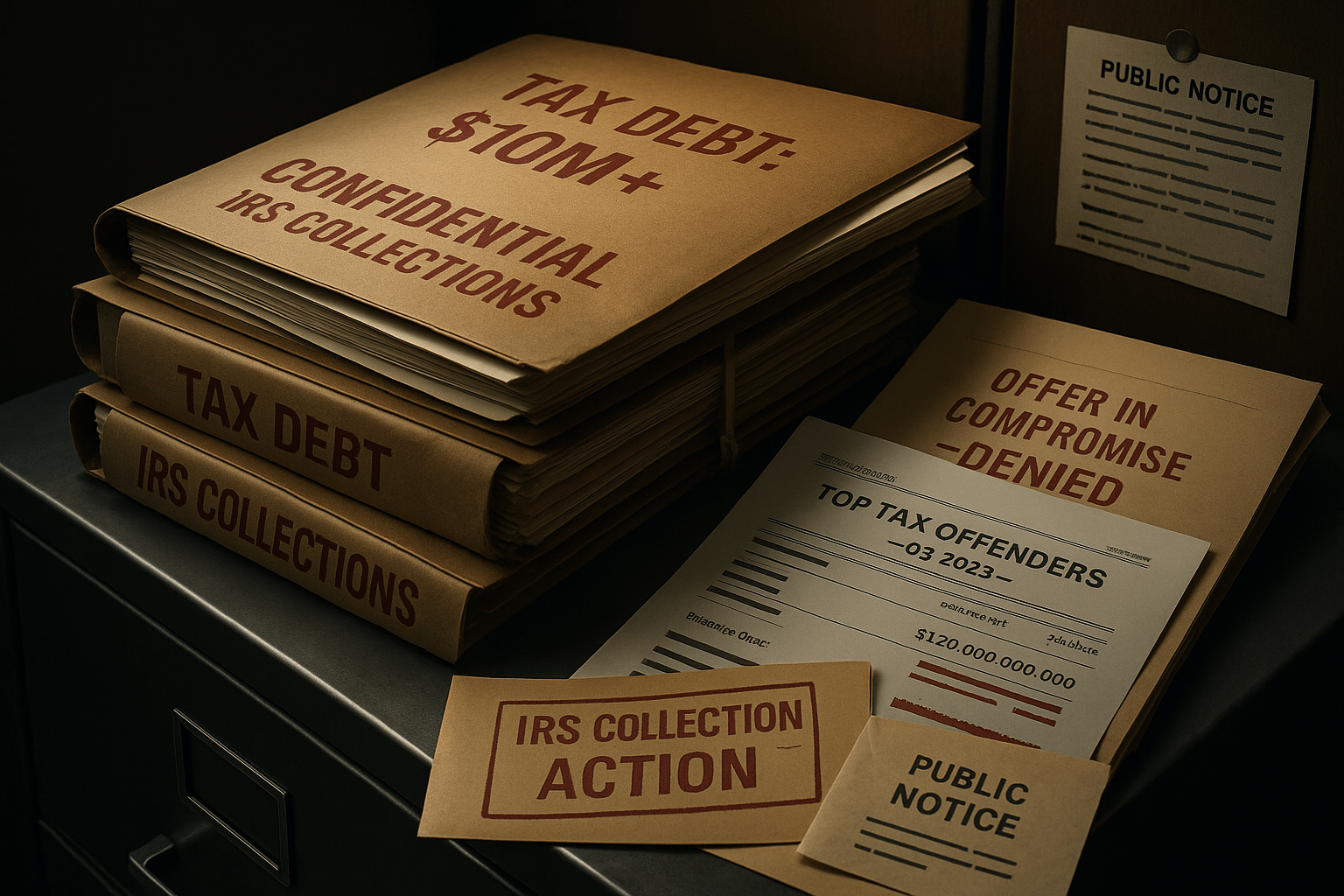

Understanding If and When Tax Debt Is Ever Forgiven Is tax debt ever forgiven? For many taxpayers burdened by unpaid taxes, the possibility of relief may seem out of reach. However, the IRS does offer programs that can forgive, reduce, or delay tax debt collection—but only under specific financial and legal conditions. Knowing your options […]

Understanding IRS Debt Expiration and the Statute of Limitations IRS debt expiration refers to the period after which the IRS can no longer legally collect on a tax debt. This is governed by a statute of limitations that protects taxpayers from indefinite collection efforts. Understanding how this timeline works—and how it can be paused or […]

Understanding When and How Tax Debt Is Inheritable Is tax debt inheritable? This question often comes up when someone is managing the estate of a deceased loved one. While tax debt doesn’t usually pass directly to heirs, there are situations where the estate, or in rare cases, family members, can become responsible. Let’s break down […]

How Forgiveness of Tax Debt Can Help You Start Fresh Forgiveness of tax debt is a real option for individuals and businesses struggling to pay what they owe the IRS. Through programs like Offer in Compromise or hardship relief, the IRS provides opportunities to settle tax liabilities for less than the full amount owed. IRS […]

Tax Debt Management Tips That Actually Work Tax debt management is a critical step for anyone struggling with IRS notices or growing tax balances. With the right approach, you can reduce what you owe, stop collection actions, and take back control of your finances. Why Tax Debt Happens in the First Place Tax debt can […]

Who Owes the IRS the Most Money: A Closer Look at Top Tax Offenders Who owes the IRS the most money? This question highlights the extreme end of tax delinquency in America. The IRS maintains a list of the most delinquent taxpayers—individuals and businesses who owe millions in unpaid taxes. The IRS lists those owing […]

- 1

- 2