Tax Debt Consolidation Loans: A Smart Way to Manage IRS Debt

How Tax Debt Consolidation Loans Help You Simplify IRS Payments

Tax debt consolidation loans offer a solution for taxpayers overwhelmed by multiple balances and mounting interest. These loans allow you to roll all tax-related debt into a single monthly payment, often at a lower interest rate. For many, it’s a lifeline to avoid IRS collections and reduce financial stress.

When the IRS starts sending notices—or worse, garnishing wages or placing liens—consolidation can feel like a way out. But is it always the right move? Understanding how these loans work, what they cost, and the risks involved can help you make an informed choice for your situation.

What Are Tax Debt Consolidation Loans?

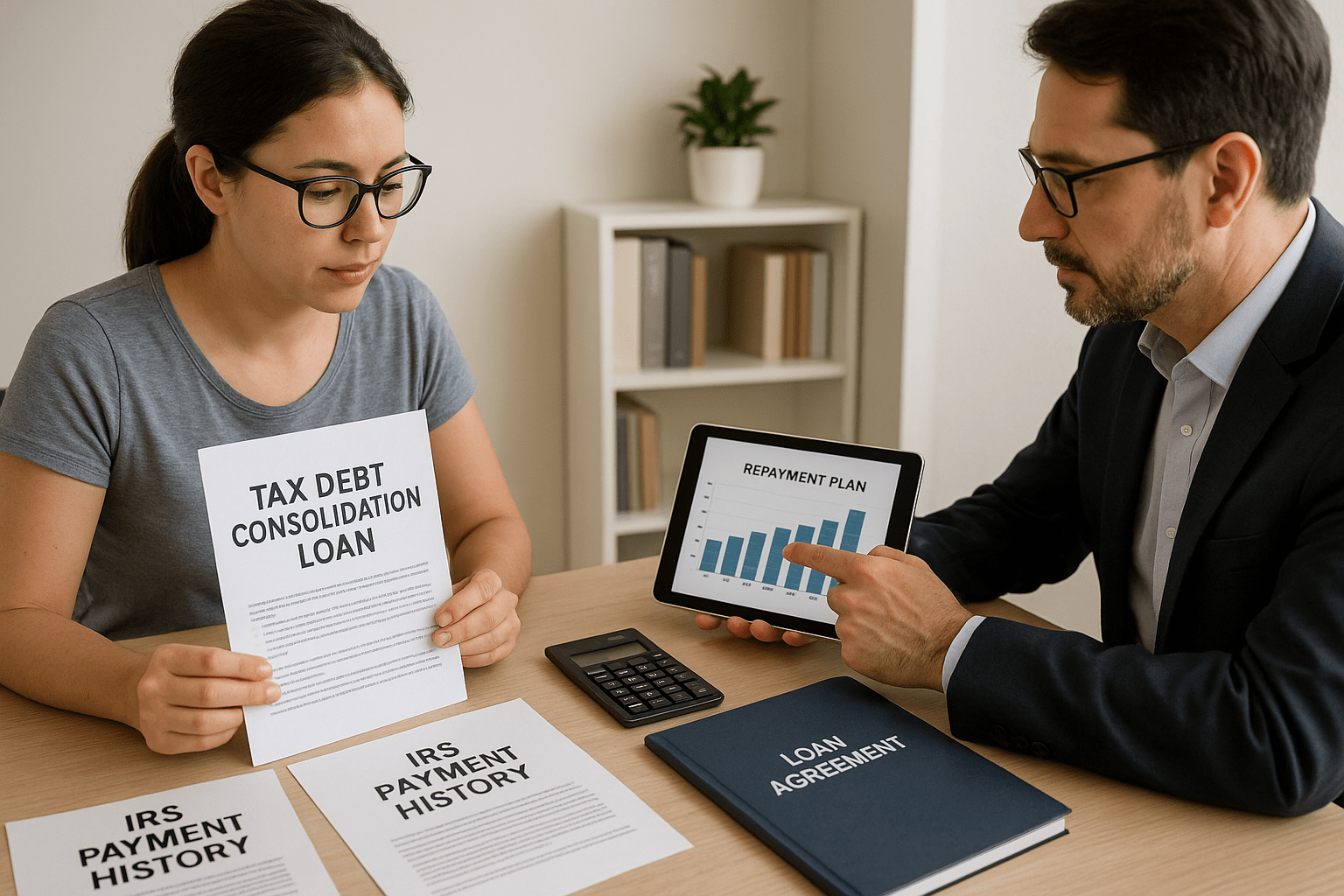

Tax debt consolidation loans are personal or secured loans used to pay off existing IRS or state tax debt. Once approved, you use the loan proceeds to clear your tax balance, replacing it with a single loan payment to your lender.

Types of Loans for Tax Debt Consolidation

- Unsecured personal loans: Based on your credit and income

- Home equity loans or lines of credit (HELOCs): Secured by your property

- Installment loans: Offered through online lenders or banks

Unlike IRS installment plans, these loans are provided by private institutions and may offer more flexible repayment terms.

Benefits of Using a Loan to Consolidate Tax Debt

There are several reasons why some taxpayers choose tax debt consolidation loans over IRS repayment options.

Fewer Monthly Payments and Reduced Stress

Instead of juggling IRS notices, penalties, and deadlines, you make a single payment each month. It simplifies your finances and makes budgeting easier.

Lower Interest Rates

If you qualify for a competitive rate, your new loan may cost less than the penalties and interest charged by the IRS.

Avoiding IRS Enforcement Actions

Once the loan pays off your tax debt, you’re no longer subject to IRS collections like wage garnishment or bank levies, as long as you keep up with loan payments.

Risks and Drawbacks to Consider

While tax debt consolidation loans can be helpful, they aren’t without downsides.

Turning Tax Debt Into Secured Debt

Using a home equity loan means your property is on the line. Defaulting could put your home at risk, even though the IRS debt was previously unsecured.

Fees, Interest, and Repayment Terms

Some lenders charge origination fees, high interest rates, or impose strict repayment timelines that may not work with your income.

Credit Score Requirements

If your credit is poor, you may not qualify for favorable loan terms—or any loan at all.

How to Qualify for Tax Debt Consolidation Loans

To get approved, you’ll need to meet specific lender requirements and submit key financial documents.

Common Qualification Criteria

- Credit score above 620 (higher scores typically result in more favorable terms)

- Verifiable income and steady employment

- Acceptable debt-to-income ratio

Required Documents

- Proof of income (pay stubs or tax returns)

- Government-issued ID

- IRS account transcript or debt summary

Choosing the Right Lender

Look for institutions with clear terms, strong reviews, and no hidden fees. Avoid payday lenders or offers that sound too good to be true.

Consolidating Tax Debt Could Help You Regain Control

Tax debt consolidation loans can offer a clear path to resolving IRS debt—especially when penalties are growing and payment plans are no longer working. However, some taxpayers may qualify for IRS debt forgiveness programs as an alternative solution. But consolidation is a financial tool, not a fix-all. If used wisely, it can provide relief and structure. If rushed into, it could turn tax problems into loan problems.

Always assess your ability to repay and compare all available options before moving forward.

Get the Help You Need to Consolidate Tax Debt Effectively

Considering tax debt consolidation? Legal Brand Marketing connects you with trusted professionals who can review your finances, explain your loan options, and help determine whether consolidation is the right move. Don’t wait for IRS enforcement to escalate—explore your options today with guidance you can trust.

Frequently Asked Questions

1. Can I use a personal loan to pay off IRS tax debt?

Yes, if approved. Many borrowers use personal loans to pay off IRS balances and manage their payments more easily.

2. Will a consolidation loan stop IRS collections?

Yes, once the IRS debt is paid off using the loan, collections will stop. But you’ll need to keep up with loan payments.

3. What credit score is needed for tax debt consolidation?

Most lenders require a score of at least 620, but better rates come with scores above 700.

4. Are tax debt consolidation loans available to self-employed individuals?

Yes, though you’ll need to show consistent income through tax returns or business statements.

5. Do tax professionals recommend consolidation loans?

Only when they align with your budget and financial goals. For some, IRS payment plans may be better.

Key Takeaways

- Tax debt consolidation loans simplify payments by replacing IRS debt with a single loan.

- Benefits include lower interest, fewer penalties, and reduced financial stress.

- Risks include loan fees, secured debt obligations, and credit qualification hurdles.

- Not all taxpayers will qualify for favorable terms—shop lenders carefully.

- A professional can help you decide whether consolidation is the right strategy.

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.Advertising. This site is a marketing service and does not provide legal or tax advice. Submitting information does not create an attorney-client, tax professional-client, or any other advisory relationship. Results are not guaranteed. A list of participating attorneys, tax firms, and tax providers is available here.

IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems

Recent Posts

- How Hard Is It to Get Innocent Spouse Relief | Understanding Your Approval Chances

- Should You File Innocent Spouse Relief After an Injured Spouse Claim Denial?

- Am I Liable for My Husband’s Tax Debt? | Understanding Spousal Tax Responsibility

- Can I Get My Tax Refund from Being Garnished? | Expert Relief Options

- How Do You Get a Refund If You Are Granted Innocent Spouse Relief?