Cost of Hiring a Tax Debt Lawyer: Complete 2025 Pricing Guide

Pricing Breakdown: Cost of Hiring a Tax Debt Lawyer

Hiring a tax debt lawyer typically costs between $2,500 and $15,000, depending on your case’s complexity and the payment arrangement you choose. Simple matters like setting up payment plans may fall on the lower end, while complex cases involving multiple tax years or business debt can reach the higher range.

Several factors influence these costs, including the amount you owe, the number of tax years involved, and whether you’re dealing with liens or levies. The attorney’s experience level and your geographic location also play a role in pricing.

Most tax lawyers offer different payment structures—from hourly rates to flat fees—which we’ll explore in detail. Professional representation can provide expertise in negotiating with the IRS and navigating complex tax procedures.

Fee Structures: Understanding Tax Lawyer Payment Models

Tax attorneys typically offer several payment structures to accommodate different budgets and case types. Understanding these options helps you choose the most cost-effective arrangement for your situation.

Hourly Rate Breakdown by Experience Level

Most tax lawyers charge hourly rates ranging from $200 to $600, with fees varying based on experience and location. Entry-level attorneys typically charge $200-$300 per hour, while seasoned tax specialists with decades of experience command $400-$600 hourly. Mid-level attorneys generally fall in the $300-$450 range.

Flat Fee Services: What’s Included

Many attorneys offer flat-fee packages for common services like installment agreement applications ($1,500-$3,500) or offer in compromise submissions ($3,000-$7,500). These arrangements provide cost certainty and often include initial consultations, document preparation, IRS negotiations, and follow-up communications.

Retainer vs. Pay-as-You-Go Options

Retainer agreements require an upfront payment (typically $2,500-$10,000) that the attorney draws from as work progresses. This approach often secures lower hourly rates and priority service. Pay-as-you-go billing allows you to pay monthly for services rendered, providing more flexibility but potentially higher overall costs.

Contingency fees, where attorneys collect a percentage of tax savings, are rare in tax debt cases but occasionally available for specific situations.

Geographic Impact: Regional Variations in Legal Costs

Location significantly affects tax debt lawyer fees, with costs varying by as much as 200% between different markets. Understanding these regional differences helps you budget appropriately and explore cost-saving options like remote representation.

Highest Cost Markets (NYC, SF, LA)

Major metropolitan areas command premium pricing due to higher operating costs and competitive markets. New York City attorneys typically charge $400-$600 per hour, while San Francisco and Los Angeles lawyers range from $350-$550 hourly. These markets also see higher flat fees, with offer in compromise services often costing $5,000-$10,000.

Most Affordable Legal Markets

Smaller cities and rural areas offer more budget-friendly options, with hourly rates often 30-50% lower than major markets. Attorneys in cities like Kansas City, Indianapolis, or Phoenix may charge $200-$350 per hour for similar expertise levels. Flat-fee services in these markets typically range from $2,000-$5,000.

Remote Representation Advantages

Many tax issues can be handled remotely, allowing you to hire qualified attorneys from lower-cost markets regardless of your location. Since most IRS interactions occur via phone, mail, or online, geographic proximity isn’t always necessary. This approach may offer cost advantages while still providing access to experienced tax professionals who specialize in federal tax law.

Case Complexity: How Your Situation Affects Pricing

Your tax debt’s complexity directly impacts legal costs, with simple payment arrangements costing significantly less than multi-year disputes or criminal tax matters. Understanding where your case falls on this spectrum helps set realistic budget expectations.

Low-Complexity Cases: Basic IRS Payment Plans

Straightforward situations like setting up installment agreements for individual taxpayers typically cost $1,500-$3,500 in flat fees. These cases involve minimal documentation, standard IRS forms, and routine negotiations. Examples include single-year debt under $50,000 with no complications like liens or levies already in place.

Medium-Complexity: Penalty Abatement and Appeals

Mid-level cases involving penalty disputes, innocent spouse claims, or offers in compromise range from $3,000-$7,500. These situations require detailed financial analysis, extensive documentation, and potentially multiple rounds of IRS negotiations. Appeals processes and collection due process hearings also fall into this category.

High-Complexity: Criminal Tax Issues and Multiple Entities

Complex cases involving potential criminal exposure, business entities, or multi-year tax disputes can cost $7,500-$25,000 or more. These situations often require coordination with criminal defense attorneys, forensic accounting, and extensive litigation preparation.

Key Complexity Factors:

- Number of tax years involved

- Total debt amount

- Business vs. individual taxpayer status

- Existing IRS enforcement actions

- Potential criminal liability

Service Breakdown: What You’re Actually Paying For

Understanding exactly what services your legal fees cover prevents surprise charges and helps you evaluate different attorneys’ value propositions. Most tax debt lawyers structure their services in tiered packages with clearly defined inclusions.

Essential Services Included in Base Fees

Standard representation typically includes initial case evaluation, strategy development, and primary IRS communications. Most attorneys include document preparation for key forms, direct negotiation with IRS representatives, and regular case updates. Base fees usually cover one primary resolution attempt, such as an installment agreement application or offer in compromise submission.

Additional Services That Cost Extra

Services beyond the initial scope often incur additional charges. These include amended tax returns ($500-$1,500 per year), appeals processes ($2,000-$5,000), collection due process hearings ($3,000-$7,000), and representation for multiple tax years. Emergency levy releases and expedited processing typically cost $1,000-$3,000 extra.

Value-Added Services Worth Considering

Many attorneys offer enhanced services like ongoing compliance monitoring, annual tax planning consultations, and priority communication access. While these add 15-25% to base costs, they often prevent future tax problems.

Typical Service Timeline:

- Week 1-2: Case assessment and strategy development

- Week 3-6: Document preparation and initial IRS contact

- Week 7-12: Negotiation and resolution implementation

- Ongoing: Compliance monitoring and follow-up communications

Budget Planning: Hidden Costs and Additional Expenses

Beyond attorney fees, tax debt cases often involve additional expenses that can add 10-30% to your total costs. Planning for these extras prevents budget surprises and ensures you have adequate resources to see your case through completion.

Mandatory Court and Filing Fees

Certain proceedings require unavoidable fees paid directly to courts or administrative bodies. Tax Court petitions cost $60, while bankruptcy filings related to tax debt range from $335-$1,717 depending on the chapter filed. IRS user fees for installment agreements ($31-$225) and offers in compromise ($205) are standard requirements that attorneys cannot waive.

Optional but Recommended Services

Professional services beyond basic legal representation often prove valuable for complex cases. Certified public accountant consultations typically cost $150-$400 per hour for financial analysis or amended return preparation. Expert witnesses in valuation disputes charge $300-$500 per hour, while forensic accountants for business cases command $400-$600 hourly.

Additional Expense Categories:

- Document retrieval fees: $50-$200 per request

- Certified copies and notarization: $25-$100

- Travel expenses for hearings: $200-$1,000+ depending on location

- Communication costs: $50-$150 monthly for priority phone/email access

- Rush processing fees: $500-$2,000 for expedited service

Setting aside 20% of your attorney fees for miscellaneous expenses provides a comfortable buffer for most cases.

Smart Investment: Cost of Hiring a Tax Debt Lawyer vs. DIY Risks

While legal fees may seem substantial, professional representation often pays for itself through better outcomes and avoided penalties. Understanding the financial risks of self-representation helps justify the investment in qualified legal counsel.

ROI Analysis: When Legal Fees Pay for Themselves

Professional representation can help ensure compliance with IRS deadlines and procedures. Failed attempts result in wasted time, continued penalty accrual, and potential loss of negotiating leverage.

Warning Signs You Need Professional Help

Certain situations virtually guarantee poor DIY outcomes. These include tax debts exceeding $25,000, multiple tax years involved, existing liens or levies, potential criminal liability, or business tax issues. IRS audit notices, appeals processes, and collection due process hearings also require specialized knowledge.

Time Investment Reality: Self-representation typically requires 40-80 hours of research and IRS interaction, often resulting in suboptimal outcomes. Most taxpayers find their time better invested earning income while professionals handle negotiations efficiently.

Final Decision: Is the Cost of Hiring a Tax Debt Lawyer Worth It?

For most taxpayers facing significant IRS debt, professional representation proves financially beneficial despite upfront costs of $2,500-$15,000. The decision ultimately depends on your debt amount, case complexity, and personal comfort level with IRS procedures.

Consider professional help if your tax debt exceeds $10,000, involves multiple years, or includes enforcement actions like liens or levies. The combination of better settlement outcomes, penalty avoidance, and time savings typically justifies legal fees for these situations.

Beyond financial considerations, professional representation provides invaluable peace of mind. Knowing an experienced attorney handles IRS communications reduces stress and allows you to focus on your business or career while experts navigate complex tax laws.

The long-term benefits extend beyond immediate debt resolution. Attorneys often structure settlements to prevent future problems, provide ongoing compliance guidance, and establish positive IRS relationships that benefit you for years. When weighing costs against potential savings, stress reduction, and professional expertise, most taxpayers find quality legal representation delivers strong returns on investment.

Next Steps: Get Your Tax Debt Lawyer Cost Estimate

Contact our experienced tax debt attorneys at tax debt lawyer for a free consultation and personalized cost estimate. Our team can review your specific situation and discuss transparent pricing for all available legal options. Visit tax debt lawyer today to schedule your consultation and discuss available legal options for addressing your IRS debt. Don’t let tax debt compound with penalties and interest—take action now and explore your options with our qualified legal professionals.

Frequently Asked Questions

1. How much does a tax debt lawyer cost for an IRS payment plan?

Setting up a basic installment agreement typically costs $1,500-$3,500 in legal fees. Simple cases with straightforward income documentation often fall on the lower end, while complex financial situations require more attorney time and cost more.

2. Are tax debt lawyer fees tax deductible?

Legal fees paid for tax advice and representation are generally deductible as miscellaneous itemized deductions, subject to certain limitations. Consult your tax professional about your specific situation and current tax law changes.

3. What's the difference between a tax lawyer and tax resolution company costs?

Tax lawyers typically charge $200-$600 per hour or $2,500-$15,000 for full representation. Tax resolution companies often charge similar amounts but may lack legal credentials. Always verify credentials and fee structures before hiring.

4. Can I negotiate tax lawyer fees?

Many tax attorneys offer flexible payment arrangements, including payment plans and reduced rates for financial hardship cases. Discuss your budget openly during initial consultations—many lawyers will work with you on pricing.

5. How long does tax debt resolution take and how does that affect costs?

Most tax debt cases resolve within 3-12 months. Simple payment plans may take 30-60 days, while complex Offers in Compromise can take 6-24 months. Longer cases typically involve more legal fees due to extended representation needs.

Key Takeaways

- Budget Range: Most taxpayers pay $2,500-$15,000 for comprehensive tax debt legal representation

- Payment Flexibility: Hourly rates, flat fees, and payment plans accommodate different budgets and case types

- Regional Variation: Legal costs vary significantly by location, with major cities charging 50-100% more than rural areas

- ROI Consideration: Professional representation often saves more than it costs through reduced penalties and better settlement terms

- Complexity Matters: Simple payment plan setups cost significantly less than complex multi-year tax debt resolution cases

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.Advertising. This site is a marketing service and does not provide legal or tax advice. Submitting information does not create an attorney-client, tax professional-client, or any other advisory relationship. Results are not guaranteed. A list of participating attorneys, tax firms, and tax providers is available here.

IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

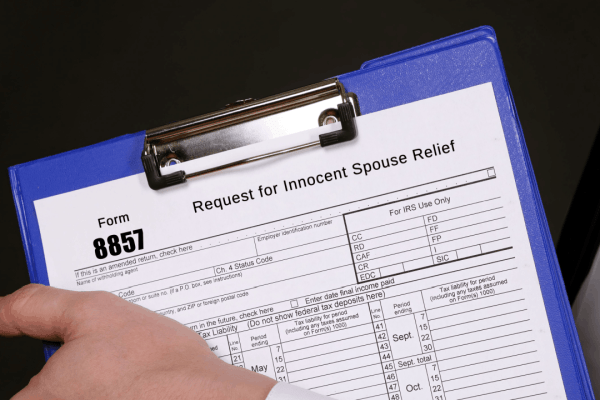

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems

Recent Posts

- How Do You Get a Refund If You Are Granted Innocent Spouse Relief?

- How to Seek Innocent Spouse Relief from Unfair Tax Debt

- How to Get Innocent Spouse Relief | Navigate IRS Forms and Appeals

- Who Is Eligible for Innocent Spouse Relief and How Does It Work?

- What is an Effective Tax Strategy for Married Couples