How to Settle with the IRS by Yourself: Your Complete Independence Guide

How to Settle with the IRS by Yourself

Learning how to settle with the IRS by yourself gives you direct control over your tax resolution process. The Internal Revenue Service offers several settlement options for taxpayers who cannot pay their full tax liability. With proper preparation and understanding of available programs, you can successfully negotiate your own tax settlement without hiring expensive representation.

Understanding Available Settlement: IRS Payment Options Overview

The IRS provides multiple pathways for taxpayers seeking relief from tax debt. An Offer in Compromise (OIC) allows you to settle your tax debt for less than the full amount owed, typically when paying the full amount would cause financial hardship. Installment agreements let you pay your debt over time through monthly payments. Currently Not Collectible (CNC) status temporarily halts collection activities if you demonstrate financial hardship.

Payment plans remain the most accessible option, with online applications available for balances under $50,000 through the IRS Online Payment Agreement tool. The IRS charges setup fees ranging from $31 to $225, depending on your chosen payment method and income level. Direct debit agreements offer the lowest fees and fastest processing times.

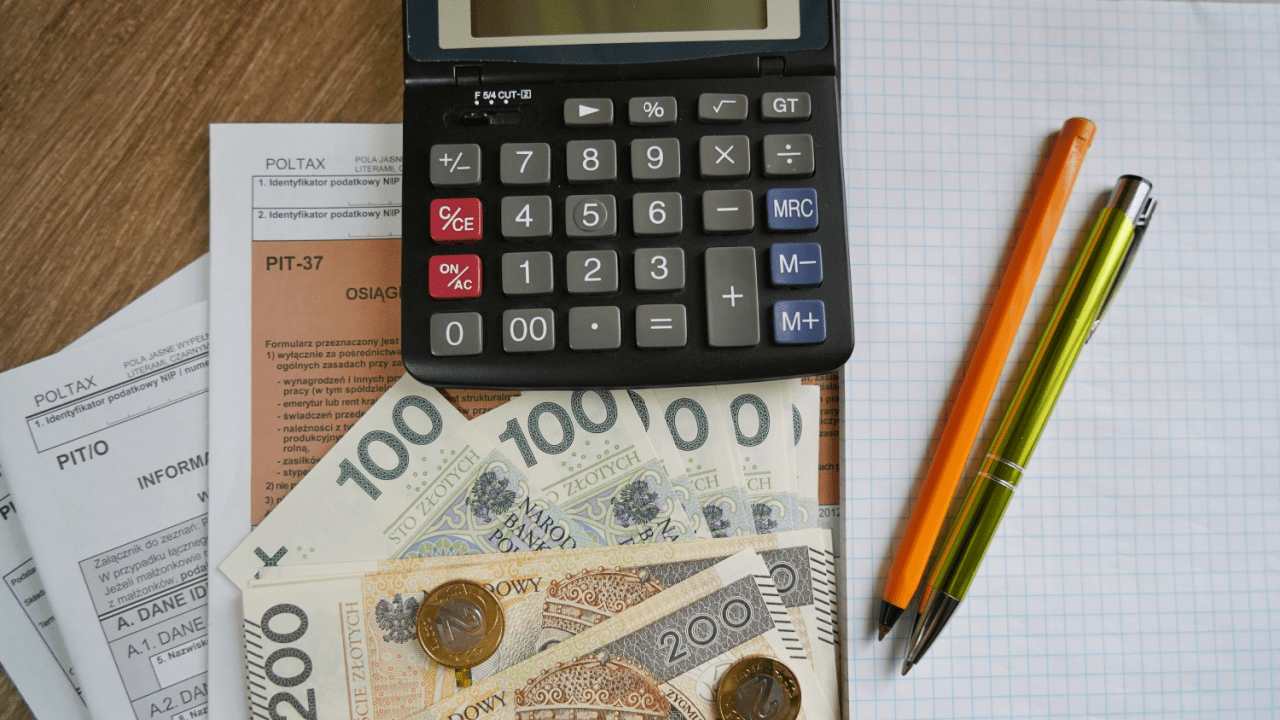

Documentation Requirements: Essential Paperwork for Self-Settlement

Successful self-settlement requires comprehensive financial documentation. Gather your most recent tax returns, bank statements, pay stubs, and proof of monthly expenses including housing, utilities, transportation, and necessary living costs. The IRS uses Form 433-A (Collection Information Statement) to evaluate your financial situation for most settlement programs.

For Offers in Compromise, you’ll need Form 656 along with detailed asset valuations and income projections. Document all debts, including credit cards, mortgages, and loans. The IRS calculates your reasonable collection potential based on asset equity and future income capacity, so accuracy in reporting is crucial for approval.

Negotiation Strategies: Direct Communication with IRS Representatives

When contacting the IRS directly, maintain professional communication and document all interactions. Call the number on your tax notice or use the general taxpayer assistance line at 1-800-829-1040. Request written confirmation of any verbal agreements before making payments.

Present your financial hardship clearly with supporting documentation. Explain circumstances that led to your tax debt, such as job loss, medical expenses, or business failure. The IRS considers cooperation and honesty as positive factors in settlement decisions. Be prepared to provide additional documentation if requested and respond promptly to maintain good standing.

Common Pitfalls: How to Settle with the IRS by Yourself Successfully

Avoid these critical mistakes that can derail your settlement efforts. Missing payment deadlines or failing to file current tax returns will void most agreements. The IRS requires tax compliance for three years following an Offer in Compromise approval. Underreporting income or assets constitutes fraud and can result in criminal charges.

Don’t ignore IRS correspondence or assume problems will resolve themselves. Collection actions escalate quickly, including wage garnishments and asset seizures. Submit applications with complete documentation to avoid delays and rejections. Incomplete forms are a common reason for application denials.

Final Settlement Steps: Completing Your Independent IRS Resolution

Once you’ve identified the appropriate settlement option and gathered documentation, submit your application with required fees. Monitor your case status online through the IRS Where’s My Amended Return tool or by calling the dedicated settlement line. Maintain current tax obligations while your application is under review.

Upon approval, strictly follow all agreement terms. Make payments on time and file future returns promptly. The IRS can default your agreement for non-compliance, reinstating the full original debt plus penalties and interest.

Take Action Today: How to Settle with the IRS by Yourself

Don’t let tax debt overwhelm your financial future. Start gathering your financial documents today and determine which settlement option best fits your situation. For complex cases or additional guidance, visit taxdebtlawyer.net/ to explore professional support options that can enhance your self-settlement strategy.

Frequently Asked Questions

1. What is the success rate for self-represented IRS settlements?

Approximately 25% of Offers in Compromise are accepted, with higher success rates for installment agreements and Currently Not Collectible status applications.

2. How long does the IRS settlement process take?

Installment agreements typically process within 30-60 days, while Offers in Compromise can take 6-24 months for final determination.

3. Can I negotiate penalties and interest with the IRS?

Yes, the IRS may waive penalties for reasonable cause, but interest generally continues to accrue until the debt is fully paid.

4. What happens if my settlement application is rejected?

You have 30 days to appeal the decision or resubmit with additional documentation addressing the rejection reasons.

5. Do I need to hire a professional to settle with the IRS?

No, taxpayers can successfully handle IRS settlements independently with proper preparation and documentation.

Key Takeaways

- The IRS offers multiple settlement options including payment plans, Offers in Compromise, and Currently Not Collectible status

- Complete financial documentation is essential for successful self-representation in IRS settlement negotiations

- Maintaining tax compliance during and after settlement is crucial to avoid agreement default

- Direct communication with IRS representatives requires professional documentation and prompt responses

- Self-settlement can save thousands in professional fees while maintaining control over your tax resolution process

Free Tax Case Review

If you are struggling with tax debt or have received a letter from the IRS complete the form below.Advertising. This site is a marketing service and does not provide legal or tax advice. Submitting information does not create an attorney-client, tax professional-client, or any other advisory relationship. Results are not guaranteed. A list of participating attorneys, tax firms, and tax providers is available here.

IRS Audit

You received an audit notice from the IRS

Tax Debt Relief

You owe the IRS money and are looking for relief options

Wage Garnishment

The IRS is taking part of your wages to pay off your debt

Tax Lien

The IRS put a legal claim on your property

IRS Property Seizure

The IRS is going to take your property to pay down or pay off your tax debt

Penalty Abatement

You want to request to remove or reduce penalties assessed by IRS

Innocent Spouse Relief

Relief from joint tax debt caused by your spouse or former spouse

Tax Debt FAQ

Common facts, questions and answers about tax debt and tax debt reilef

Tax Debt Lawyer

A tax debt lawyer can help you with your tax debt problems

Recent Posts

- How to Get Innocent Spouse Relief | Navigate IRS Forms and Appeals

- Who Is Eligible for Innocent Spouse Relief and How Does It Work?

- What is an Effective Tax Strategy for Married Couples

- What are the Proofs of Innocent Spouse Relief?

- What Form Do You Use for an Innocent Spouse? | Complete IRS Filing Guide